- Quick recap: What are salary surveys?

- Salary surveys pros and cons

- Best alternative to salary surveys for up-to-date compensation data: Real-time salary benchmarking tools

- What are other sources of compensation data beyond salary surveys

- How to combine salary surveys with compensation benchmarking software?

- In summary: Should you use salary surveys, compensation software, or both?

- FAQs:

While credible, salary surveys are not always reliable for compensation benchmarking.

Because they update only once or twice a year and rely on manual submissions, the data is often outdated, error-prone, and sourced from legacy companies that rarely match your size, stage, or region.

That makes them a risky foundation for high-stakes compensation decisions — especially in today’s fast-moving talent market.

In this guide, you’ll learn:

- Where salary surveys still add value and where they fall short

- The pros and cons of salary surveys and other benchmarking sources

- How modern salary benchmarking tools compare to traditional providers

Whether you’re planning salary bands, setting competitive pay for new roles, or leading compensation reviews, you’ll leave with a clearer picture of which approach — surveys, software, or both — fits your organisation best.

Quick recap: What are salary surveys?

Salary surveys are the traditional method for salary benchmarking i.e. collecting and analysing compensation data for specific job roles, offering HR teams insights into:

- Base salary range

- Variable pay

- Total compensation (including benefits, equity, and bonuses)

They help you understand how compensation varies across roles, seniority levels, industries, and regions.

Typically, large global HR consultancies like Radford or Korn Ferry conduct these surveys. HR and People Teams purchase them either as a full dataset or a custom peer-group report, tailored to specific locations, industries, or company sizes.

Historically, this data was shared in spreadsheets. Today, several providers offer a built-in software platform (e.g. The Radford Platform) to view and analyse benchmarking data online.

Salary surveys used to be the only way to benchmark compensation and understand market trends — but that’s no longer the case.

Who provides salary survey data?

Salary surveys are typically conducted by large global HR consultancy firms, with the top providers including:

- Radford

- Mercer

- Willis Towers Watson (WTW)

- Korn Ferry

- Culpepper

- Croner

- Empsight

- Altura

There are also third-party benchmarking data tools, such as Payscale, that aggregate salary survey data from several providers, allowing users to access and compare multiple datasets in one platform.

Dig deeper: The best (and worst) tools for salary benchmarking.

Why and when do HR teams rely on salary survey data?

Companies use salary surveys for salary benchmarking — aligning employee compensation with the wider market to ensure fair and competitive pay.

Salary survey data also becomes especially important when:

- Creating or adjusting salary bands. Benchmarking data helps you determine the midpoint of each salary band, based on the desired target percentile.

- Setting pay for new roles. While ideal org structures have salary bands for every role, that’s rarely the case in practice. When new roles are added, benchmarking data guides fair starting compensation.

- Running annual compensation reviews. During compensation cycles, salary survey data supports market adjustments to employee salaries and overall bands — ensuring pay stays competitive as the market evolves.

That said, all these decisions — from setting pay for new roles to running annual comp reviews — require current, reliable market data to get right.

But this is where salary surveys fall short, since the data is often outdated by the time it reaches you (learn more below).

In contrast, modern HR teams are turning to real-time benchmarking tools like Ravio that offer fresher, more targeted compensation data when you need it most.

Salary surveys pros and cons

Salary surveys are credible and offer access to wide-ranging data. But they often fall short on data freshness and usability — struggling to support fast-moving teams that need real-time, role-relevant compensation data.

Here’s a quick overview of the benefits and disadvantages of salary surveys, followed by a more detailed breakdown of each:

Pros | Cons |

|---|---|

Brand trust and credibility make it easy to get stakeholder buy-in. |

Outdated data. Surveys are typically conducted annually, meaning the data usually doesn’t reflect the current market realities.

|

Extensive data coverage across job roles, levels, and industries, especially large enterprise data. |

Error-prone data collection. Survey participants are required to submit data manually, increasing the risk of inaccuracies.

|

|

Broad, misaligned peer groups. Predefined survey groups often include companies that don’t match your company size, stage, or region.

|

|

Inaccurate job matching. Difficult to align internal roles with survey jobs, especially for hybrid or non-standard positions.

|

|

Difficult to navigate. Survey results are often delivered in spreadsheets that require manual filtering and interpretation.

|

|

Incomplete solution. Most providers offer data only, without tools for budgeting, banding, or internal parity checks.

|

Salary benchmarking surveys pros

1. Brand credibility makes it easier to win internal buy-in

Salary surveys are typically published by large, established HR consultancies like Radford, Mercer, or Willis Towers Watson — names that carry industry-wide recognition.

Thanks to their long-standing reputation, these providers often hold more weight with executive stakeholders, making it easier for HR and People teams to secure buy-in.

2. Extensive data coverage across industries, roles, and levels

Salary surveys often collect compensation data from some of the world’s largest corporations — giving you access to wide-ranging benchmarks across job functions, seniority levels, and geographic regions.

This breadth of data can be especially helpful when building compensation frameworks for multiple markets or making high-level strategic decisions that require a global view.

But as we’ll see below, that same breadth can become a limitation — especially as the dataset becomes too broad or complex to reflect your organisation’s structure or job roles with real-time accuracy.

Salary benchmarking cons

1. Outdated data makes it harder to stay competitive

Given their large-scale nature, salary surveys are usually conducted once a year, with data typically aggregated and released months after collection.

By the time results reach you, they reflect only a single point in time — already out of date. And it’s another 12 months before new benchmarking data becomes available.

In fast-moving talent and compensation markets, this lack of freshness makes it harder to offer market-competitive salaries and respond quickly to shifting pay trends.

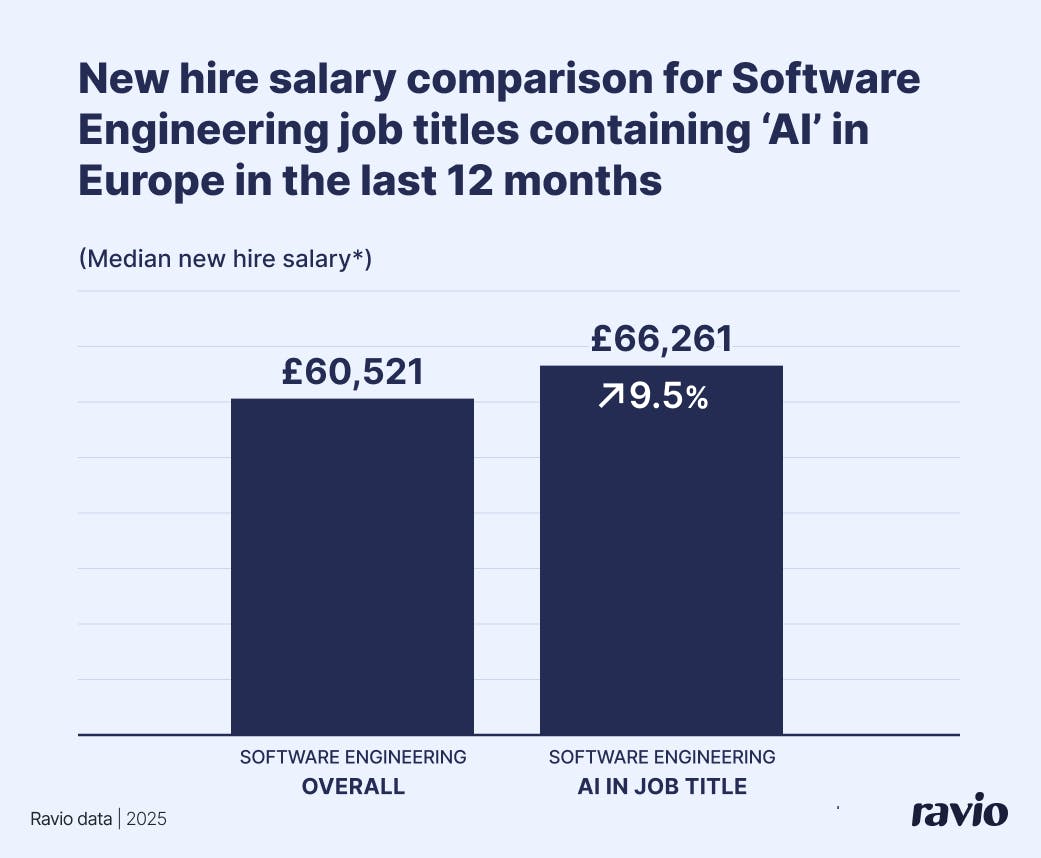

One example: Ravio’s latest tech job market report, based on real-time salary data, shows that AI roles have drastically increased in demand at the start of 2025, with AI Engineers now commanding at least a 10% market premium compared to Software Engineers.

This example shows just how essential real-time salary data is (it won’t even show up in salary surveys until next year).

To stay ahead of these shifts and ensure pay stays fair and competitive, companies need access to benchmarking data that’s more than a once-a-year snapshot.

2. Manual data entry increases the risk of data inaccuracies

To purchase salary survey data, companies must contribute their own — a model known as “give-to-get.” That means HR and People teams are required to compile and submit detailed employee compensation and org structure data to providers.

The submission process usually involves uploading data through Excel templates or platforms like Mercer’s Data Connector, each requiring detailed inputs on base pay, variable pay, benefits, and more.

Because the lengthy process involves manually extracting, formatting, and inputting data and aligning it with the provider’s job and level frameworks, human error is almost inevitable.

For HR teams, that raises major concerns about data quality: if even a small percentage of survey participants misclassify a role or mistype a number, it can skew the benchmarks you’re relying on to make compensation decisions.

3. Broad peer groups that don’t match your size, stage, or region

Most salary surveys default to enterprise roles and public company data — creating a major mismatch for HR and People teams, especially if you’re a private company, startup, or scaleup.

You end up relying on misaligned market data from companies you don’t actually compete with for talent.

That’s because most salary surveys are run by large HR consultancies that primarily serve global enterprises — particularly in legacy industries like manufacturing or oil and gas.

When they conduct surveys, they sort participants into predefined peer groups using broad filters like industry, size, or region.

While some providers offer custom peer group reports, these come at an extra cost and still only include companies that participated in the survey, which often excludes younger, fast-growing companies.

For HR and People teams, this results in benchmarks that look comprehensive on the surface but fail to reflect the reality of your hiring market, making it harder to set competitive, relevant pay.

4. Inaccurate job mapping undermines benchmarking accuracy

Manual, complex submissions make salary survey data too inconsistent to accurately map jobs and internal salary bands to external benchmarks — especially for hybrid or non-standard roles.

That’s because salary surveys collect data from large, legacy enterprises with complex organisational structures and layered role hierarchies.

As part of the process, participating companies must manually align their roles and levels to the provider’s predefined job catalogue and level framework.

But these frameworks aren’t always intuitive. Radford’s tech compensation survey, for instance, includes 899 unique job titles — leaving plenty of room for misinterpretation.

The result? A wide margin for error. And because submissions are manual, there’s no real way to validate them, adding to inconsistencies in the dataset.

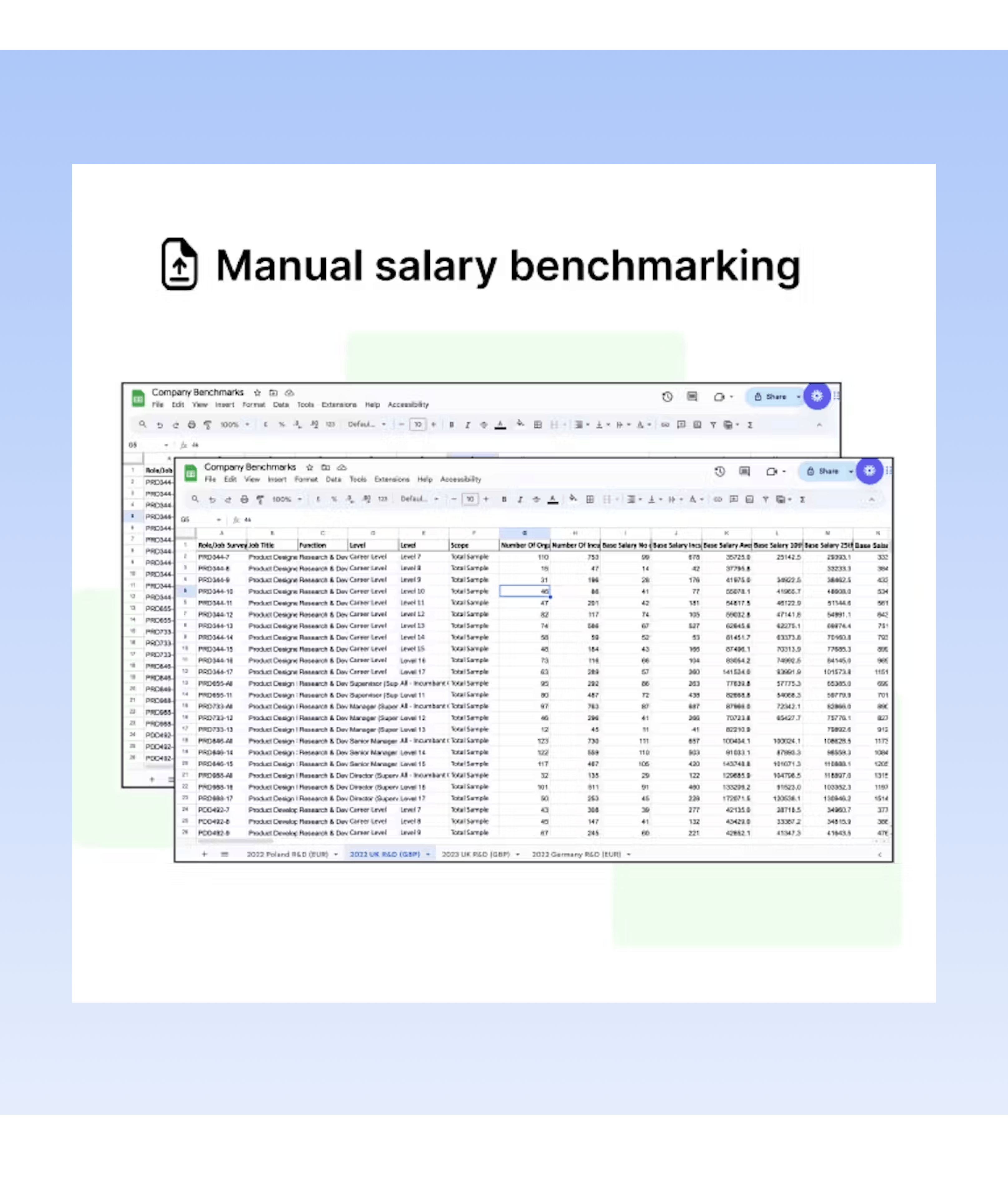

5. Hard to navigate survey submissions and access data

Salary surveys make compensation data hard to access and even harder to interpret or use.

For one, you can only purchase data after manually submitting your employee compensation, following a give-to-get model.

This process can be super time-consuming — often taking days (or even weeks) to complete. You have to extract employee data from your HR systems and reformat it to match the provider’s submission template.

Second, the data is delivered in massive spreadsheets packed with hundreds of job titles, levels, and compensation figures.

There’s no intuitive way to filter or find what’s relevant, especially since salary surveys rely on rigid job catalogs that often don’t accurately reflect the way your company defines job roles.

No wonder we hear many People teams describe it as “spreadsheet hell.”

Finally, none of this is a one-off effort. You have to repeat the entire process every year — making it a recurring burden, not a one-time investment.

Sure, some providers now offer platforms like Radford or Korn Ferry Pay. But they’re consultancies first and their platforms are only secondary.

User reviews confirm those platforms aren’t easy to navigate either and come with limited functionality from a compensation tool. So the spreadsheet pain just gets ported over to software.

The result? You end up spending hours wrangling messy data — only to do it all over again next year.

6. Not a full compensation management solution

Salary surveys give you one-off benchmarking data but little else.

While it's increasingly becoming common for some salary survey providers to offer platforms to analyse data online rather than a spreadsheet, they don’t offer a full compensation management solution.

Some platforms may include additional features. The Radford Platform, for instance, lets you build a job architecture structure.

Still, essential features like salary banding, pay equity checks, and compensation review planning (e.g., budgeting scenarios) needed to fully use benchmarking data are missing.

That’s because most salary survey providers are large HR consultancies specialising in designing and implementing compensation structures through one-off projects, not building comprehensive software platforms for ongoing support.

Sure, you can hire them for additional consulting support. But that still won’t give your team the integrated tooling needed to manage compensation day to day.

So if you’re a fast-growing or global team that needs real-time benchmarking and day-to-day compensation management tools in one place, salary surveys won’t help — they’re built for one-off consulting, not everyday comp decisions.

Best alternative to salary surveys for up-to-date compensation data: Real-time salary benchmarking tools

Real-time salary benchmarking tools are the strongest alternative to traditional surveys for up-to-date, role-specific compensation data.

Unlike surveys, they integrate with your HRIS, update continuously, and reflect current market conditions — making them far more reliable for compensation planning and salary decisions.

Here’s a quick comparison between traditional salary surveys and real-time benchmarking tools, followed by the details:

Traditional salary surveys | Real-time salary benchmarking tools |

|---|---|

Out-of-date data. | Real-time data from HRIS integration. |

Error-prone manual data. | Data direct from source, no lengthy manual submissions. |

Broad, misaligned peer group. | Relevant data pool and filtering functionalities available. |

Hard-to-navigate survey submissions and access data. | Intuitive software that gives you instant access to data insights. |

Inaccurate job matching. | Job level mapping done for you. |

One-off data snapshot with no additional tools to analyse and use the data. | Comprehensive compensation management functionality. |

Real-time vs outdated salary data

Compensation benchmarking software typically gathers compensation data through integrations with company HRIS systems.

Through the integration, the benchmarking data is automatically updated to reflect salary changes or additional new hire salaries added to the HRIS.

Compared to static and outdated spreadsheets from salary survey providers, this means the benchmarks you see are always up-to-date and reflect the quickly changing talent market.

HRIS-based benchmarking vs manual data entry

Salary benchmarking tools automatically gather compensation data from your HRIS system — needing no manual input on your end. This eliminates human error from the process.

Bonus: Data in benchmarking software, Ravio, is verified by our in-house benchmarking experts and data science team. This ensures a high degree of accuracy, as well as a high degree of consistency in how data is labelled and interpreted, which is key to producing reliable benchmarks.

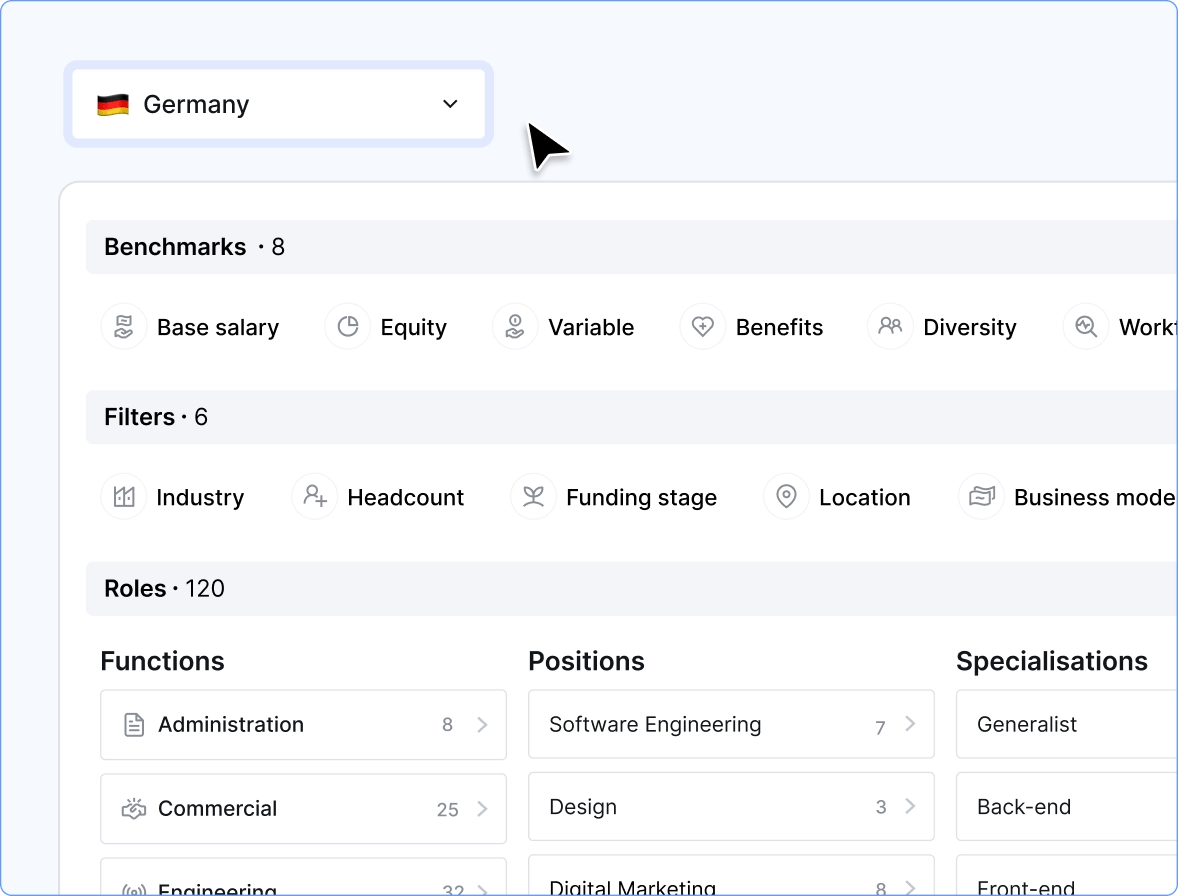

Accurate, relevant market benchmarks vs broad peer groups

Modern benchmarking tools typically draw from a more targeted data pool than salary surveys. For instance, Ravio's dataset is primarily made up of high-growth tech companies.

This minimises the data skew caused by the majority of salary survey data points coming from a handful of the world’s largest (often legacy) businesses. Meaning: the benchmarks are much more relevant from the start.

Benchmarking platforms also let you easily filter data for different locations, industries, company sizes, and company stages. This ensures the benchmarks and job catalogue are always highly relevant and tailored to each company, without the need to pay extra for peer group reports.

One thing to keep in mind: always check that these software tools maintain enough data breadth. Sample size is a key factor in data confidence and accuracy.

For instance, Ravio’s dataset is sourced from over 1,400 companies with over 300,000 individual employee data points. Plus, our expert data team employs advanced statistical analysis to ensure high-quality benchmarks for even the most niche roles.

Easy-to-use software vs clunky spreadsheets

Compensation software eliminates the manual wrangling required when using salary surveys for benchmarking.

With salary benchmarking software, you don’t have to wait around for a spreadsheet of data to be delivered. Instead, once you’re onboarded, you can typically access benchmarking data within minutes.

Not to mention, the HRIS integration means that no recurring manual submissions are needed to use the platform or access the data.

“Finally, a user-friendly benchmarking tool. Ravio is so easy to implement, you just integrate it with your HR system and the team then matches your roles with the right levelling."

People Director at Huma (former role)

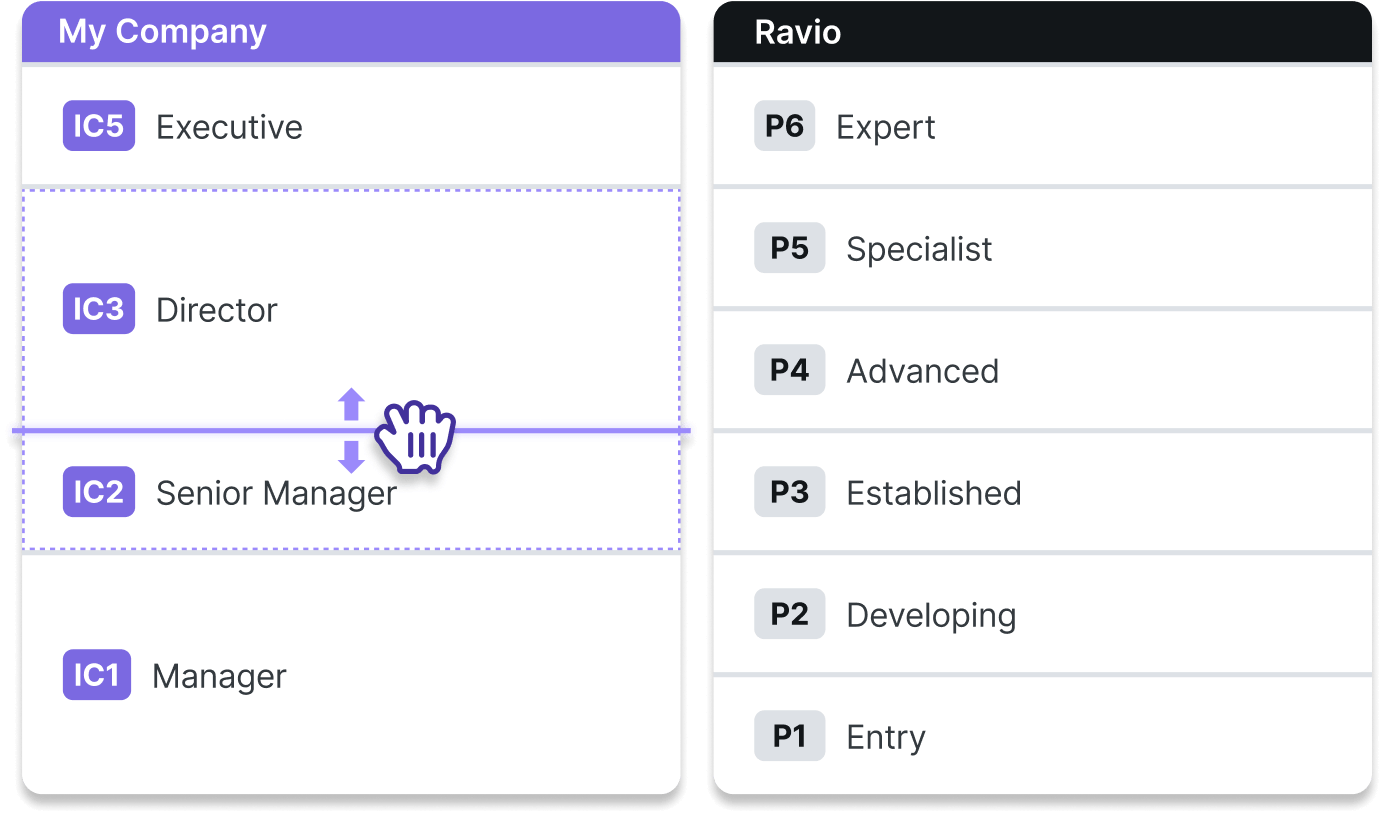

Auto-matched roles and levels vs inaccurate job matching

Salary benchmarking platforms also reduce work on your plate by automatically handling job mapping.

At Ravio, for example, the first step is mapping each customer’s job levels and/or individual employees if they don’t have a framework to Ravio’s best-practice level structure.

This removes the need for you to manually match jobs and ensures consistency in the interpretation of job roles and levels — ultimately ensuring like-for-like comparisons between company roles and market benchmarks.

If you’re evaluating different salary benchmarking providers, we’d always recommend checking how each provider manages this job level mapping. This is critical for accurate benchmarking and different platforms may take different approaches to the process outlined here for Ravio.

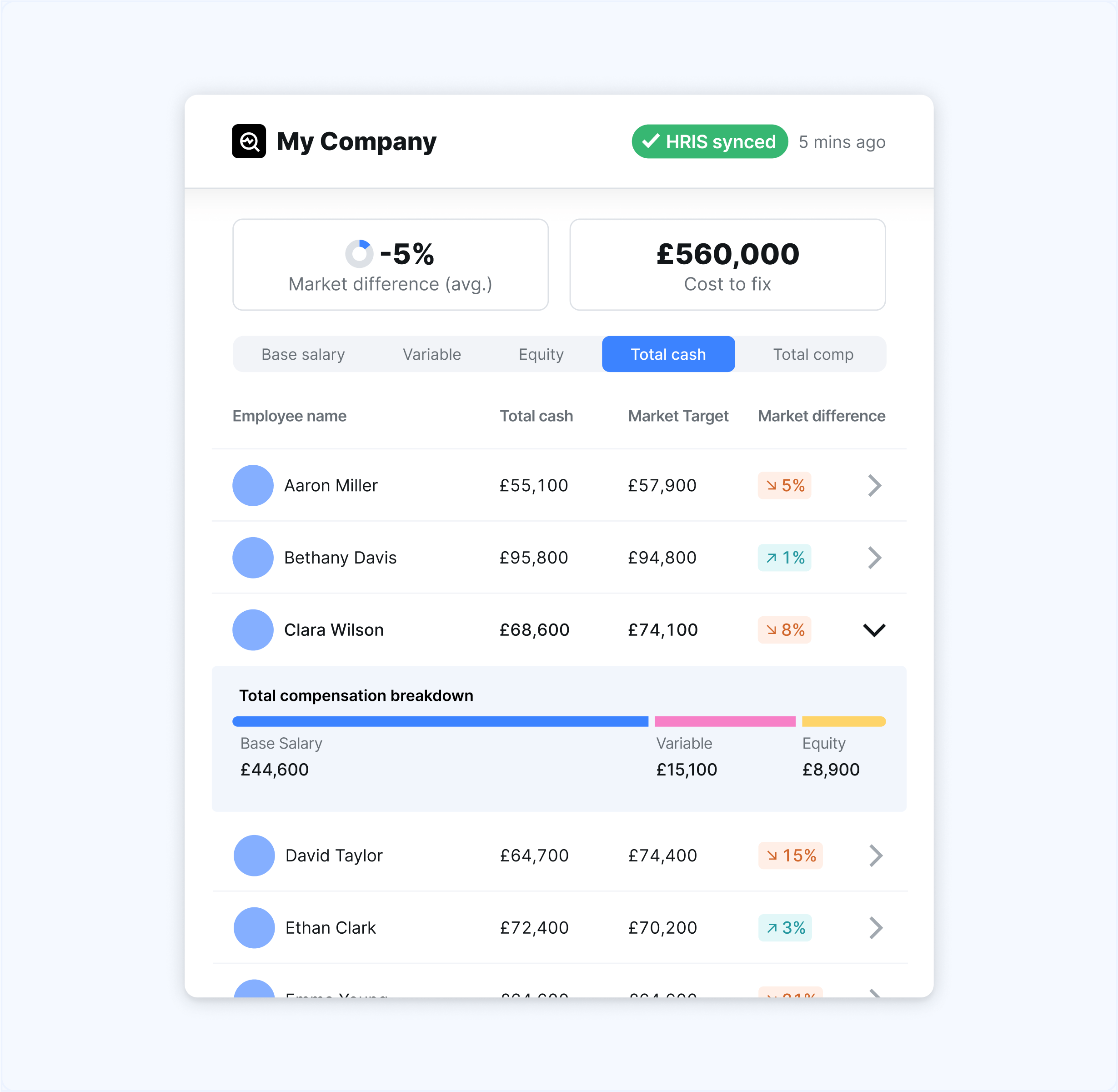

Comprehensive compensation management solution vs an incomplete solution

Not only do modern compensation management platforms provide more accurate and up-to-date benchmarking data than salary surveys, they also offer so much more.

Providers like Ravio also include additional benchmarking features, such as:

- Workforce analytics to automatically compare your employees to the market benchmarks.

- Market trends to access real-time insights on salary increases, hiring rates, attrition rates, and more.

Plus, Ravio isn’t just for benchmarking. It’s a comprehensive compensation management platform with a host of additional features compared to a salary survey dataset. This means within the platform, you can manage your day-to-day jobs like:

- Compare benchmarking data to employee compensation

- Create a salary band structure aligned with the market

- Identify band outliers or pay equity issues

- Communicate compensation packages to employees.

What are other sources of compensation data beyond salary surveys

Besides real-time benchmarking software, desk research is the last alternative to traditional salary surveys. It involves anonymous finding employee-reported salary data from either of these sources:

- Company review sites like Glassdoor

- Salary range listed in job adverts on sites like LinkedIn or Indeed

These sources are free and easy to access, which makes them appealing, but they’re both highly inaccurate sources of data.

We covered the full pros and cons of each salary benchmarking source here, but the gist is:

- Glassdoor salary data is unverified

It’s crowdsourced from users of the website with no checks to ensure that the user is submitting accurate data.

- Glassdoor’s salary averages are inaccurate

The salary range shown to you represents the average of all salaries ever submitted for that role — with no outliers taken into account. Plus, there’s no way to identify up-to-date shifts in the salary based on market trends.

Here’s just one example of a Senior Software Engineer’s salary range from Glassdoor’s salary calculator to illustrate this point.

Note that there’s no descriptive information to anchor the definition of ‘senior software engineer’ on (aside from the 1-3 years of experience, which is confusing in itself for a ‘senior’ role), and the salary range is too broad to be useful.

As for job adverts, the data lags because:

- Job adverts give you no context behind the data.

You get no idea what companies’ compensation philosophy and target percentile are or where they got their benchmarking data from. And you’re making a best guess that their interpretation of the job role and level is the same as what you’re looking for.

- There’s high data variance.

Different companies do compensation in different ways, so you’re going to find a large amount of variance in the salaries that companies are advertising.

💡 How switching from Glassdoor to Ravio brought confidence to Tiqets’ compensation strategy

Tiqets is an online booking platform for museums and attractions around the world. The company has around 230 employees, mostly based in their Amsterdam HQ but with some working remotely across different locations in Europe.

For a long time Tiqets relied on sources like Glassdoor and LinkedIn to collate salary data on which to base their employees’ compensation packages.

This was time-consuming for the People Team and led to a lack of confidence in the data, especially during compensation review conversations. As Maartje Koopman, Head of People and Culture at Tiqets, put it:

“It created frustrations with line managers. They didn’t trust the data that we came with, which made it difficult for us to discuss compensation and talk about what people’s pay should be. Were we paying the right amount to people, or were we way off in the market?”

The team has since made the switch to using Ravio, accessing reliable compensation data for relevant roles that ensures managers and employees have trust in the process.

“I think it’s so much better now. If managers look at Ravio, they see that the right comparisons are being made.”

How to combine salary surveys with compensation benchmarking software?

The question now is: can you use both salary surveys and compensation benchmarking software together? The short answer, absolutely, especially if you’re a scale-up, public company, or an organisation relying on niche, industry-specific roles.

The long answer:

Salary surveys and compensation benchmarking software don’t have to be mutually exclusive benchmarking solutions.

Some companies find it beneficial to have multiple data sources for salary benchmarking, so they opt to combine both salary survey data from a provider like Radford and a salary benchmarking tool like Ravio.

This approach is especially useful for:

- Established scale-ups and public companies with a large headcount and employees across a high number of locations, job roles, and job levels. Different providers focus on specific markets, so their data is stronger for certain roles or regions so combining sources ensures full coverage. Scale-up tech company Bolt, for example, pairs Ravio with a salary survey provider to access real-time, accurate data coverage in Estonia.

- Companies that are highly reliant on niche roles within their industry. Niche roles often lack robust sample sizes, so using multiple data sets increases confidence in your benchmarks – if you're a fintech company, for instance, using Ravio as the strongest fintech compensation dataset will help to ensure coverage.

Beyond better data coverage, combining salary surveys with compensation software also gives you access to built-in tools like their salary band tool and automated pay equity analysis that help you actually put that data to work.

In summary: Should you use salary surveys, compensation software, or both?

Whether you use salary surveys, benchmarking software, or both depends on your organisational needs — shaped by factors like your:

- Team size and complexity

- Geographic footprint

- Hiring speed, scale, and role types

- Budget and internal compensation expertise

Here’s a quick breakdown of who each option is best suited for:

Salary surveys are best suited for large, global organisations or legacy companies with in-house compensation expertise — particularly in regulated industries like finance or healthcare, where roles are well-defined and consistent across industries.

Salary benchmarking tools are best suited for fast-growing companies that need real-time, scalable compensation data — especially those expanding across regions, building salary bands, or hiring for evolving roles where traditional surveys often fall short.

A combination of salary surveys and benchmarking tools is best suited for established scale-ups and public companies with large, distributed teams — particularly those operating across multiple regions and job levels or hiring for niche roles where no single data source offers complete coverage.

FAQs:

What is the purpose of salary benchmarking?

Salary benchmarking helps companies align employee compensation with the wider market to ensure fair and competitive pay. It’s used to create or adjust salary bands, set starting pay for new roles, and guide compensation reviews — especially when making market-based adjustments.

How effective are salary benchmarking surveys in HR?

While salary surveys are credible sources, the compensation data they provide is often outdated, inconsistent, and prone to human error — making them ineffective for HR teams that need accurate, real-time insights and day-to-day tools to manage compensation.

Are salary surveys still relevant in 2025?

Although credible and still relevant for organisations needing broad compensation data, salary surveys have become less effective for salary benchmarking in fast-growing companies that need real-time, role-specific insights. The data is often outdated by the time it’s published, relies on manual submissions prone to error, and doesn’t reflect the pay practices of modern, high-growth teams.

Why is salary survey data inconsistent or unreliable?

Salary survey data is often inconsistent or unreliable because it’s outdated, manually submitted, and sourced from peer groups that rarely reflect your company’s size, stage, or market.

Do salary surveys include tools for real-time decision-making?

No, salary surveys do not include tools for real-time compensation decision-making. Most salary surveys provide one-off benchmarking data in spreadsheets or limited-access platforms, without built-in features for managing salary bands, pay equity, or compensation reviews. They’re designed for annual market comparisons, not for day-to-day compensation planning or responding to fast-changing talent trends.

How accurate are job matches in traditional salary surveys?

Job matches in traditional salary surveys are often inaccurate. As part of the “give-to-get” model, HR teams are required to manually align internal roles to rigid job catalogues — a process prone to misclassification and human error. And since submissions aren’t verified, even small errors can skew benchmarks, affecting pay decisions. The challenge grows when teams receive large, spreadsheet-based datasets with no statistical analysis applied. HR teams are left to manually match inconsistent job titles and levels to their own structure, often uncovering pay discrepancies between supposed seniority levels — further reducing the accuracy of job matches in traditional salary surveys.

Are salary surveys worth the cost for a Series A startup?

No, salary surveys are rarely worth the cost for Series A startups. They’re expensive, slow to update, and based on data from legacy enterprises, not fast-moving, high-growth tech companies. Because Series A teams hire for emerging roles in competitive markets, real-time benchmarking tools make a far better investment — offering more accurate, up-to-date data and built-in compensation management features ideal for scaling.