Mercer has longstanding credibility as a traditional salary survey provider. However, with real-time salary benchmarking tools now on the market, many companies are exploring alternatives to Mercer’s salary survey data.

Mercer’s give-to-get model also requires manual survey submissions and job mapping — adding to your workload and leaving room for errors that can skew benchmarks and misguide pay decisions.

So, as you’re exploring Mercer alternatives, we’ve reviewed the market to find the best Mercer alternatives in 2025 – comparing 11 salary benchmarking providers side-by-side with Mercer.

Whether you’re choosing your first benchmarking provider, switching from Mercer, or just supplementing its data, you’ll see how each stacks up on coverage and compensation management features to find the right fit for your organisation.

Click here to switch straight to the list of Mercer alternatives.

But first, quick refresh: What does Mercer offer?

Mercer is a global HR consultancy that helps organisations design and implement strategic compensation projects.

Alongside its consulting services, Mercer runs annual salary surveys and sells the compiled results as standalone datasets. It also provides online platforms for accessing and analysing compensation data.

Here’s a breakdown of Mercer’s main offerings:

1. Mercer consulting services

Consulting is Mercer’s core offering. These services cover a wide range of compensation practices, including total rewards strategy, job evaluation, pension schemes, and employee benefits.

2. Mercer salary benchmarking data

Mercer runs salary surveys – gathering submissions from companies on how they compensate their employees (base salary, equity, variable pay, and benefits). The results are then compiled into a dataset and sold as benchmarking data for People and Reward teams.

Mercer runs many surveys and sells a variety of datasets, such as:

- The Mercer Total Remuneration Survey (TRS). It’s Mercer’s main global survey for total compensation data, updated annually.

- Industry-specific survey. Example: Mercer Total Compensation Survey for the Energy Sector.

- Employee-specific data. Example: Mercer Hourly Pay Survey

- Insights on trending workplace topics. Example: Mercer US Flexible Working Policies & Practices Survey.

3. Mercer WIN® (Workforce Intelligence Network)

Mercer WIN is Mercer’s online data delivery platform that gives you access to the survey data you buy from the consultancy.

In the past, salary survey data purchased from Mercer used to be delivered in a spreadsheet, which users may find complex to use. Today, you can choose to have it delivered via Mercer WIN where you can view, filter, and analyse benchmarking data you’ve purchased in-platform or download it as an Excel file.

Access to Mercer WIN is included when you buy eligible survey data — it doesn’t include datasets you haven’t purchased.

4. Mercer Comptryx

Acquired by Mercer in 2015, Comptryx is Mercer’s salary benchmarking software, providing compensation and market trends data for the tech industry.

Comptryx operates on a give-to-get survey submission model – organisations submit their employee compensation data to access benchmarks, with the benchmarks reported to be updated quarterly (as opposed to real-time solutions like Ravio, where data is continuously updated via HRIS integrations).

It’s available as a standalone subscription, not included with Mercer TRS or WIN access.

Who is Mercer ideal for?

With its broad, global data, Mercer is ideal for large enterprises and multinational organisations in regulated industries such as banking, pharmaceuticals, and manufacturing that have dedicated compensation teams to manually submit, map, and analyse compensation data.

Given everything Mercer offers, the breadth of its services can feel overwhelming. And because Mercer is traditionally a consultancy rather than a modern software provider, its tooling can, in our opinion, be less suited to high-growth or scaling tech teams that need intuitive software and real-time data.

Mercer salary benchmarking pros and cons

Whilst Mercer is a well-known name with longstanding credibility, the manual nature of traditional salary survey processes mean that benchmarking data generated using these approaches can be out-of-date and prone to human error – unlike modern tools which integrate directly with company HRIS systems to ensure continuous updates and no human error.

Plus, the salary survey submissions required to use Mercer’s data also tend to be lengthy, manual processes for HR teams to complete. Both of these aspects explain why organisations may be looking for alternatives to Mercer.

Here’s a more detailed look at the pros and cons of using Mercer for salary benchmarking:

Mercer pros

The main benefits of using Mercer salary benchmarking data are:

- Brand trust and credibility. Mercer has a long-standing reputation among corporate HR teams, which can make it easier to secure stakeholder buy-in compared to its alternatives.

- Broad dataset. Mercer gathers data from large, legacy enterprises globally — making its benchmarking insights particularly valuable for multinational organisations.

- Consultancy services available. Because Mercer is a consultancy, you can also get support on the design and implementation of various compensation practices.

Mercer cons

The key limitations of using Mercer for salary benchmarking are:

- One-off surveys, rather than continuous integrations. Mercer uses a traditional salary survey process, where salary data is collected via manual survey submissions. It takes months to collect, aggregate, and publish the resulting benchmarks, so the data can be outdated by the time you receive it. In comparison, real-time salary benchmarking tools (like Ravio) connect directly with company HRIS systems to collect compensation data in real-time (including reflecting role changes, pay adjustments, or promotion increases), and update the benchmarks continuously.

- Human error. Both Mercer’s salary surveys and Mercer Comptryx rely on detailed, manual data submissions from users. This dependency means accuracy is only as strong as the inputs made and small mistakes made through human reporting can ripple across the final benchmarks.

- Manual job matching. Mercer’s comprehensive salary data is drawn from a broad pool of companies, including large, global enterprises, with a huge job catalogue containing all the different job titles, roles, and codes involved. Matching this up with your internal reality can be very labour intensive. In comparison, when you use compensation benchmarking software like Ravio you’ll have your internal job roles and levels automatically mapped to those used by the data provider, with no manual matching needed.

- Incomplete compensation management solution. Unlike other platforms, Mercer delivers compensation data as a standalone offering via salary surveys or Mercer Comptryx. Other components, such as pay band tools or consultancy projects, are sold separately, meaning it can feel piecemeal compared to a fully integrated compensation management tool.

11 best Mercer alternatives for salary benchmarking in 2025

Mercer alternatives generally fall into three categories:

- Real-time salary benchmarking software providers (example: Ravio)

- HR platforms with third-party salary data (example: Lattice)

- Traditional salary survey providers (example: Radford)

Some companies also turn to job adverts or employee-reported sites like Glassdoor. But because this data is unverified, based on historical averages, and too broad for like-for-like benchmarking, we haven’t included them here as reliable Mercer alternatives.

1. Ravio

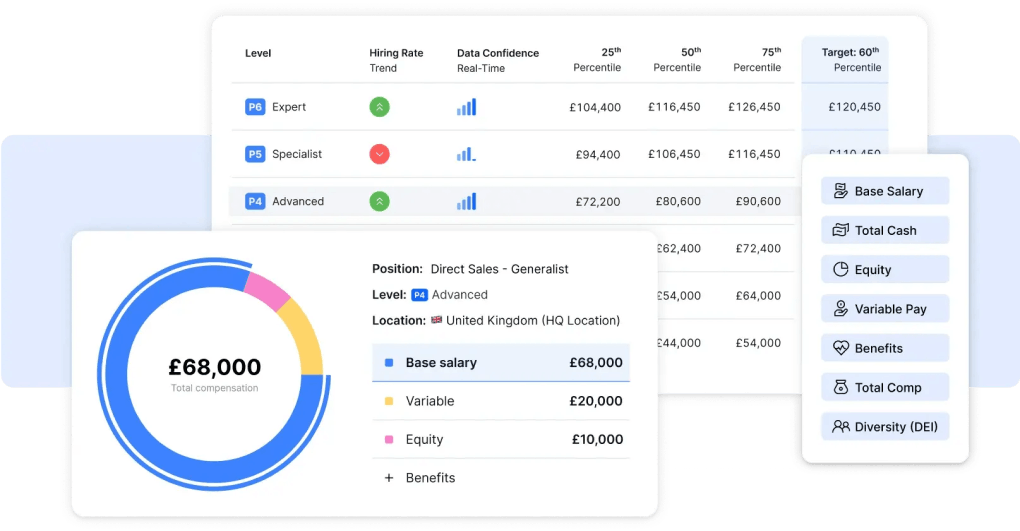

Ravio is a salary benchmarking software with built-in end-to-end compensation management tools – ideal for high-growth global tech teams, particularly those with a strong presence in Europe.

Key features:

- Get accurate, GDPR-compliant benchmarks worldwide with deep European coverage, based on data from 1,400+ companies — spanning over 50 countries and 100+ roles.

- Instant access to real-time total compensation data covering base salary, equity, variable pay, and benefits. Data refreshes automatically via HRIS integrations and includes global insights on salary shifts, attrition, and market trends.

- Filter benchmarks by industry (e.g. fintech salaries vs overall tech), size, stage, and location with your roles automatically mapped to Ravio’s leveling framework at onboarding for consistent, accurate comparisons.

- Benchmark, manage salary bands, and address pay equity in one platform with in-built tools to create, manage, and refresh salary bands, and identify the root cause of gender pay gaps.

Mercer vs Ravio:

Unlike Mercer’s manually submitted, point-in-time salary survey data, Ravio delivers real-time benchmarks via HRIS integrations – removing manual errors and keeping benchmarks current.

In terms of coverage, Mercer’s dataset leans toward legacy industries with tech insights sold separately (via Comptryx). Ravio focuses on high-growth tech companies and offers filters by location, stage, and headcount for added relevance.

As for compensation management, Mercer provides data in spreadsheets or its WIN portal, supplemented with consultancy projects and standalone tools. Ravio instead delivers a modern end-to-end compensation platform powered by accurate, real-time benchmarks.

💡Could I combine Mercer and Ravio to maximise salary benchmarking data coverage?

Traditional salary survey providers like Mercer may come with gaps in terms of data lag and relevancy, but they’ve been a trusted salary data source for a long time.

Because of this, it’s more and more common for large, established companies to use multiple salary data providers to ensure full coverage for all roles, locations, and levels required – as different providers have different market focus.

Using both Mercer and Ravio gives a secondary data source to validate trends – and Ravio addresses the key gaps in Mercer’s salary data, making it the perfect complement:

- Broad data pool skewed to legacy industries ➡️ Ravio’s data sourced from 1400+ global tech companies

- Additional dataset costs for additional locations or specific peer groups ➡️ Ravio's built-in filters for industry, location, headcount, and funding stage.

- Manual salary survey data collection ➡️ Ravio’s continuously refreshed data, and trends in hiring, attrition, and salary increases show talent market shifts as they happen.

Plus, Ravio's custom market data feature means you can upload your Mercer data into the Ravio platform, to use and compare both sources.

“Access to Ravio's live market data means no more headaches from delayed data sets or having to age compensation data, which has been a real friction point for us in the past.” – Jodi S, VP of People at Mollie

2. Pave

Pave is a US-based salary benchmarking provider offering real-time compensation data in the US and Canada — making it ideal for US-based startups and enterprises in tech, healthcare, and gaming industries.

Key features:

- Access a global dataset with strong US and Canadian coverage where 67% of benchmarks come from US companies, compared to limited (14%) representation in Europe.

- Benchmark with total compensation data covering base salary, equity, and variable pay through Pave’s give-to-get model. (Dataset is limited to base salary outside the core market though.)

- Stay up to date with data updated monthly and real-time employee information pulled directly from connected HR systems.

- Automate job role mapping with machine learning to define job levels by track, family, and number, ensuring consistent compensation planning.

- Manage end-to-end compensation workflows to track budgets, forecast pay decisions, collaborate with your team through in-app commenting and approvals, and present market trends with advanced visualisations.

Mercer vs Pave:

Compared to Mercer’s salary survey data, Pave provides fresher benchmarks through HRIS, ATS, and equity integrations that update every month.

While Pave’s dataset is strongest for US roles with lighter coverage globally, Mercer maintains broader global benchmarks.

For compensation management, Pave delivers end-to-end tools for salary bands, pay equity, and review planning in one platform, whereas Mercer combines consultancy services with add-on tools.

3. Compa

Compa is an offers-based benchmarking provider — ideal for US enterprises in tech, life sciences, and retail that want to supplement traditional salary surveys with real-time offers data.

Key features:

- Access real-time offers and equity data to benchmark salary and stock against live market trends pulled directly from ATS and HRIS integrations.

- Stay current with automated fortnightly updates that refresh benchmarks with the latest offers and new-hire market data.

- Filter and track specific peer groups to narrow benchmarks and get AI recommendations for pay adjustments and competitive hiring.

- Analyse pay by skills to benchmark compensation beyond job titles and accurately price specialised or hybrid roles.

- Use built-in workflows for offer approvals and recruiter collaboration to speed up hiring decisions.

Mercer vs Compa:

Unlike Mercer, which offers annual compensation surveys with global coverage, Compa provides real-time offer data with stronger coverage for US roles only.

Compared to Mercer’s decades of aggregated submissions, Compa’s dataset is much smaller and focused on active offers. It excludes existing employee salaries and is limited to high-volume roles that appear frequently in Applicant Tracking Systems (ATS), making Compa’s data less reliable for accurate benchmarking.

That said, Compa does offer advantages over Mercer. Whilst Compa also doesn’t automate job matching, it does have built-in outlier detection to flag mismatches and ensure accuracy.

When it comes to compensation management features, we think both fall short compared to dedicated compensation management platforms. Mercer is primarily a data provider, while Compa focuses on offers-only data with basic tools for salary bands, pay equity, and compensation reviews – meaning you’ll still need to heavily rely on spreadsheets.

4. CompUp

CompUp is a salary benchmarking provider with an India-only dataset – making it ideal for India-based startups, mid-market companies, and service firms.

Key features:

- Access real-time compensation benchmarks through automated HR and payroll integrations across India.

- Leverage live market data from 250+ Indian startups actively contributing salary and pay information for credible benchmarks.

- Filter peer baskets by stage, size, and industry to benchmark against Indian startups, though. (Note: there’s no advanced custom cohort or funding-stage segmentation.)

- Use in-built compensation management tools to simulate budgets, link pay to performance, run automated merit cycles, route approvals, and generate Total Rewards Statements.

Mercer vs CompUp

Compared to Mercer’s global dataset, CompUp’s benchmarks are tailored exclusively to the Indian talent market – making it useful for local startups but less relevant for companies hiring globally.

CompUp’s industry scope is also narrow, so its benchmarks can also be unreliable for niche, senior, or globally distributed roles.

As for comp management features, CompUp offers built-in tools for budgeting, merit cycles, and approvals – functionality that Mercer lacks.

5. Carta Total Comp

Carta Total Comp is the salary benchmarking tool from cap table platform Carta — ideal for VC-backed, US-based private companies already using Carta to manage ownership and equity.

Key features:

- Access real-time salary and equity benchmarks from Carta’s proprietary dataset of US-based, private-market companies.

- Automatically sync compensation, job levels, and employee data through 100+ HRIS integrations.

- Integrate cap table data to track ownership, forecast vesting schedules, and manage share allotments.

- Use built-in compensation management tools for scenario planning, equity dilution, ownership impact, and structured workflows to plan, approve, and audit offers.

Mercer vs Carta Total Comp

Compared to Mercer’s broad total compensation data, Carta is strongest in equity benchmarking, while its salary data is less robust since the platform is primarily built for cap table management.

In fact, Carta focuses on privately held US startups already using its cap table management platform – making its benchmarks less relevant for public companies or those hiring globally.

In contrast to Mercer’s compensation management tools (available as add-ons), Carta offers stronger, end-to-end functionality. For existing Carta users, setting up Total Comp is also as simple as plug and play.

6. Compensation IQ by Qlearsite

Compensation IQ by Qlearsite is a salary benchmarking provider that combines third-party data – ideal for public sector organisations, charities, and nonprofits across Europe, with particular strength in the UK.

Key features:

- Combine multiple data sources with manual uploads, a Mercer partnership, and job posting salary ranges via Lightcast (Note: Compensation IQ doesn’t have proprietary data).

- Integrate HRIS systems to compare internal salaries against external benchmarks.

- Use AI-powered job mapping to automate role alignment and standardise benchmarking.

- Leverage customisable dashboards to highlight compensation metrics, trends, and areas of concern.

Mercer vs Compensation IQ:

Unlike Mercer’s global salary benchmarks, Compensation IQ is a data aggregator – combining benchmarks from user uploads, job posting ranges, and Mercer itself.

Subsequently, its compensation data isn’t real-time or highly reliable as up-to-date, accurate benchmarks from modern salary benchmarking tools like Ravio. The sources Compensation IQ draws from may be subject to human error and lagging due to the data collection process (salary surveys), or unverified and inconsistent (job postings) – making data less relevant for fast-moving tech companies.

In terms of compensation management features, Mercer doesn’t provide automated job mapping, while Compensation IQ does. It also integrates with HRIS to compare internal salaries with external data, though not to build a real-time dataset.

7. Assemble by Deel

Assemble is a compensation management tool sourcing salary benchmarks via Carta – ideal for privately held healthcare and biotech companies in the US.

Key features:

- Access specialised biotech and life sciences compensation data via Compgrid, Assemble’s native dataset, and wider US-based benchmarks via a third-party integration to Carta.

- Import and combine compensation data from multiple sources with manual uploads and job mapping.

- Use built-in compensation tools to create salary bands, run structured reviews, generate offer letters, and manage customised workflows for planning and approvals.

- Improve pay transparency with a self-serve employee portal that gives employees visibility into their total rewards package.

Mercer vs Assemble:

Unlike Mercer, which offers proprietary compensation data with global coverage, Assemble owns only a small, native biotech dataset and relies on manual uploads from users, plus an integration with Carta Total Comp for broader, US-focused data. .

While this allows you to pull in multiple data sources, the benchmarks aren’t as real-time as those from modern providers like Ravio that automatically embed proprietary data. Meaning: Assemble’s data freshness ultimately depends on the update cycles of its external sources.

It also adds manual work for users, who need to upload, manage, and map multiple datasets – similar to work that goes into Mercer’s manual survey submissions and role-mapping. As a result, Assemble still leaves the same gaps that drive teams to consider Mercer alternatives.

As for compensation management features, Assemble provides end-to-end tools, while Mercer relies on separate add-ons.

8. Barley

Barley is a compensation management platform that sources benchmarking data from third-party providers like Mercer – ideal for small businesses in the US and Canada.

Key features:

- Access benchmarking data from multiple sources, including Mercer salary survey data and real-time employee data through HRIS integrations. (Note: Barley doesn’t have a proprietary database.)

- Collect and report on candidate salary expectations to spot market shifts and use them as an additional source of pay trend data.

- Plan and manage compensation reviews end-to-end with built-in tools to build and edit salary bands, analyse pay equity gaps, set budgets, and run adjustments using a merit matrix approach.

Mercer vs Barley:

Where Mercer is a consultancy that sells annual survey data and add-on tools for compensation management, Barley is a dedicated compensation management tool with third-party data, HRIS integrations, and built-in workflows.

However, because Barley doesn’t maintain a proprietary dataset, its benchmarks still rely heavily on traditional salary surveys. That means the data lags behind the market, carrying the same risks of being outdated, error-prone, or incomplete – limiting its usefulness for competitive pay decisions.

9. Lattice

Lattice is a broad people management platform that has expanded to offer compensation benchmarking via third-party sources – ideal for mid-market teams that need basic total compensation coverage within a broader people platform.

Key features:

- Access global salary benchmarks with expanding European coverage, though data quality varies by region.

- Use Mercer benchmarks alongside internal performance data to align pay decisions with the market and career progression.

- Manage basic compensation workflows integrated into performance management cycles, with built-in tools for salary band setup, merit cycle budgeting, and compliance reporting.

Mercer vs Lattice:

Unlike Mercer’s consultancy-first model with salary surveys and optional add-on tools, Lattice delivers a broader HR platform with performance reviews, engagement surveys, and compensation features, so their core focus areas differ.

Both rely on periodic salary survey data rather than real-time HRIS integrations. There are also no talent market insights, such as live market trends, hiring rates, and attrition data, essential for competitive new hire compensation decisions.

10. HiBob

HiBob is a broad HRIS platform with a compensation module, where salary benchmarks are provided via Mercer Comptryx – ideal for SMBs with simple compensation needs that they want to manage within their performance platform.

Key features:

- Access compensation data from third-party providers like Mercer within an EU-compliant people management platform.

- Support compensation planning with periodic refreshes from external survey data partnerships (typically annual — not in real time).

- Run basic compensation workflows with built-in tools for total compensation analysis, pay equity analysis, and standard reporting. (Note: High-growth companies quickly outgrow these features and eventually turn to a dedicated real-time compensation benchmarking platform.)

Mercer vs HiBob:

Unlike Mercer’s single-source salary surveys, HiBob combines Mercer data with other third-party providers inside a broader people management platform. This makes HiBob more useful for mid-market companies that want compensation insights embedded within their HR workflows.

However, both Mercer and HiBob lack real-time insights since HiBob’s benchmarks ultimately refresh in line with Mercer’s periodic survey updates.

For compensation management, HiBob includes simple, built-in tools for comp reviews, pay equity analysis, and reporting — whereas Mercer follows a consultancy-first model supported by optional add-on tools.

That said, HiBob’s capabilities are still limited compared to specialised benchmarking software. Its data lacks specialised tech insights, making it less effective for high-growth or tech-focused companies.

11. Alternative salary survey providers: Radford, Willis Towers Watson, Korn Ferry

Mercer is just one of several HR consultancies that provide salary data through the same salary survey process – others include:

- Radford

- Willis Towers Watson

- Korn Ferry

- Culpepper

- Salary.com

- Empsight

- Altura

- Brightmine (previously XpertHR and Cendex)

Some of these providers today have a platform for analysing the salary survey results they sell. However, these are all consultancy-first benchmarking providers, so their platforms tend to be outdated and difficult to use.

Data limitations are also similar to Mercer’s: subject to manual survey submissions and may take months for the data to reach you.

Factors to consider when choosing the best Mercer alternative for your needs

When selecting an alternative to Mercer’s salary benchmarking solution, review the following key factors to assess your organisational needs:

- Team size and complexity. Smaller companies often benefit from platforms that offer pre-built pay bands to get started quickly, while larger enterprises need flexible tools that can support complex hierarchies and workflows.

- Geographic footprint. If you hire across multiple regions, prioritise providers with global coverage and strong filtering by country, city, industry, and funding stage.

- Hiring speed, scale, and role types. High-growth companies need real-time benchmarks that reflect current market shifts, especially for competitive or niche roles.

- Budget and internal compensation expertise. Consider whether you need an all-in-one platform with planning tools or just reliable benchmarks to supplement in-house expertise.

So is Mercer still the best salary benchmarking option?

Mercer is great as a data source for large, multinational organisations that need global benchmarks from a credible name.

But if you’re a high-growth tech company in a competitive talent market, you might find Mercer salary survey data doesn’t quite fit your needs, due to the manual nature of survey submissions and data delivery, as well as the challenges with potentially outdated data when you need to know what’s changing in the market right now.

In that case, a modern compensation platform with real-time benchmarks and built-in compensation management features like Ravio may serve you far better.

📊 Looking to switch to Ravio for real-time salary benchmarking?

Explore the most comprehensive real-time total reward data set with 3 benchmarks for free, or if you’d like a full tour of the Ravio platform book a demo with one of our experts.

FAQs

Is Mercer data reliable?

Mercer is a credible brand but, because its benchmarks rely on traditional salary survey collections rather than real-time HRIS integrations, its insights can lag behind the market and may not reflect current pay trends. The manual nature of traditional salary survey submissions also leaves such data prone to human error.

What is Mercer software?

Mercer’s main compensation software is Mercer Comptryx, originally acquired in 2015. It provides salary benchmarking and market trends data for the tech industry, based on Mercer’s give-to-get survey model. Comptryx is sold as a standalone subscription — separate from Mercer’s global Total Remuneration Survey (TRS) and its online survey data portal, Mercer WIN.

Does Mercer integrate with HRIS systems?

Unless you purchase Mercer ePrism, Mercer survey data does not integrate directly with HRIS systems. To compare benchmarks with your employee data, HR teams must manually combine Mercer datasets with internal HRIS exports – a process that has to be repeated every time data changes.

What is the difference between Mercer TRS, Mercer WIN, and Mercer Comptryx?

Mercer Total Remuneration Survey (TRS) is Mercer’s core global salary survey. Mercer WIN is the online platform used to access TRS or other survey data you purchase. Mercer Comptryx is a separate subscription product for the tech industry, offering salary benchmarking and market trends based on Mercer’s give-to-get survey model.

Is there a real-time alternative to Mercer salary surveys?

Yes. Modern salary benchmarking platforms like Ravio, Pave, and Figures integrate directly with HRIS systems to provide live salary benchmarks that update automatically. Unlike Mercer’s manually collected survey data, these tools reflect current market conditions and internal pay changes in real time – typically making them more reliable for fast-moving compensation decisions.

Are salary surveys still relevant in 2025?

Salary surveys are still used, but their relevance is fading fast. Because they’re only updated once or twice a year and rely on manual submissions, the data is often outdated and error-prone by the time you receive it. Most surveys also pull from large, legacy enterprises, so benchmarks rarely reflect your company’s size, stage, or region — which is why many companies now turn to real-time benchmarking tools that integrate with HRIS data.

Salary surveys are still used, but many companies now complement annual surveys with real-time sources. Because salary surveys are typically only updated once or twice a year and rely on manual submissions, the data is often outdated by the time you receive it and can be error-prone. Most surveys also pull from large, legacy enterprises, so benchmarks rarely reflect your company’s size, stage, or region – which is why many companies now turn to real-time benchmarking tools that integrate with HRIS data.

What is the best salary benchmarking tool?

The best salary benchmarking tool meets your organisational needs — integrating with your HRIS systems and offering real-time salary and total rewards data. It should also offer strong data coverage tailored to your needs, whether that’s regional benchmarks or global market data, depending on your team’s structure and hiring footprint.