- Hiring rates in Australia in 2025 are outpacing global tech hubs

- Attrition rates in Australia in 2025: Talent is on the move

- Average salaries in Australia in 2025: What does fair and competitive compensation look like for Australian startups?

- Pay equity in Australia in 2025

- Key takeaways: What these trends mean for your hiring plans and compensation strategy

- FAQs

The Australian tech ecosystem is in the midst of a golden moment.

Q1 2025 marked the strongest quarter for Australian startup funding in the past three years (with 2024 already marking an 11% year-on-year increase in funding raised).

But how are these growing Australian startups approaching hiring and compensation?

In this article we’ll explore Ravio’s data on the key trends shaping how Australian companies attract, retain and reward talent – and what it means for your hiring and compensation strategies in 2025.

Plus, to help translate these trends into practical insights, we've partnered with Matt McFarlane, Director at FNDN and expert in startup compensation. Matt works with several scaling Australian tech companies on their compensation strategies, giving him a front-row seat to how these market dynamics play out in practice.

Let's dive into the data and explore what it means for building competitive, sustainable talent strategies in Australian tech.

Subscribe to our newsletter for monthly insights from Ravio's compensation dataset and network of Rewards experts 📩

Hiring rates in Australia in 2025 are outpacing global tech hubs

Hiring in Australia is on the up.

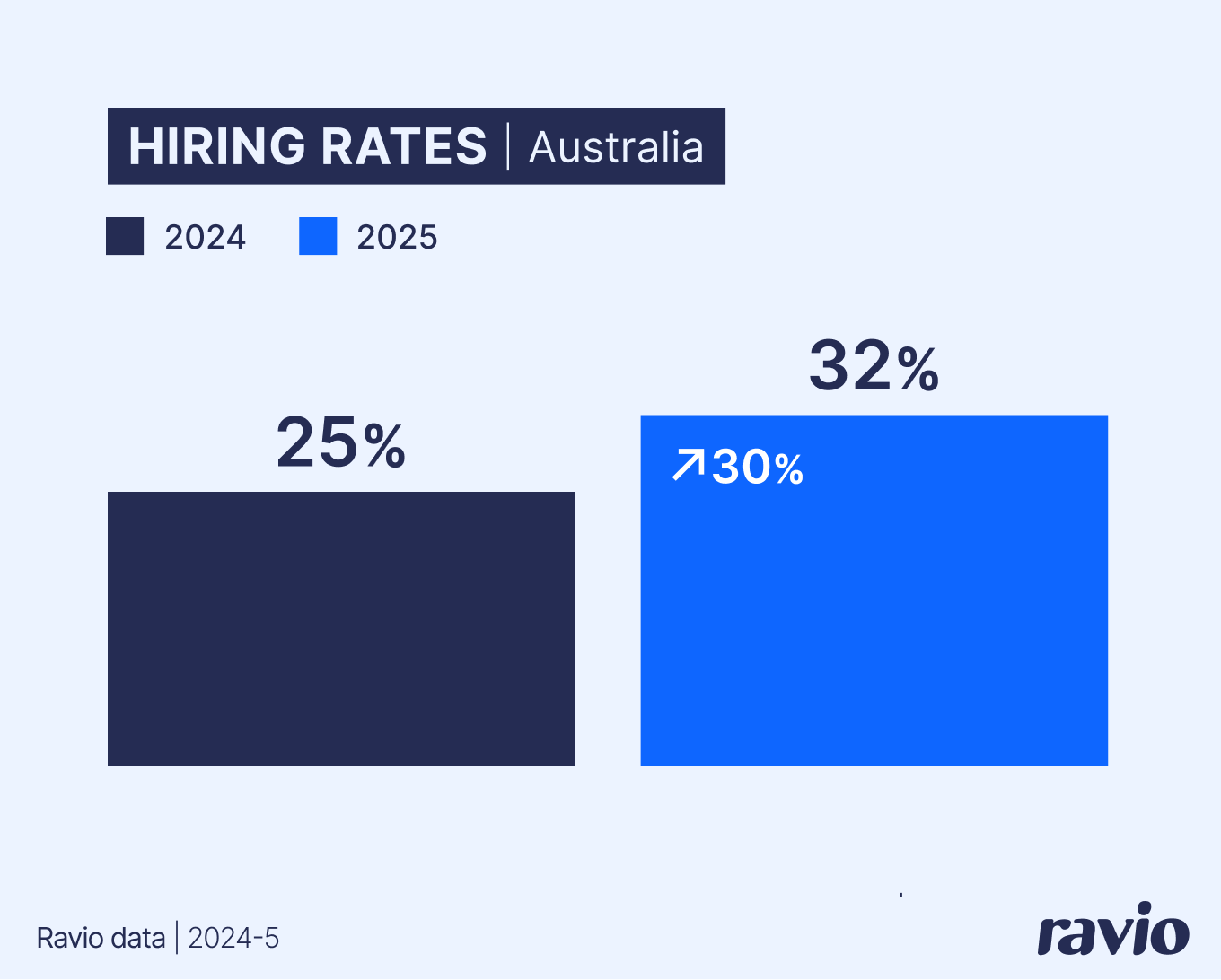

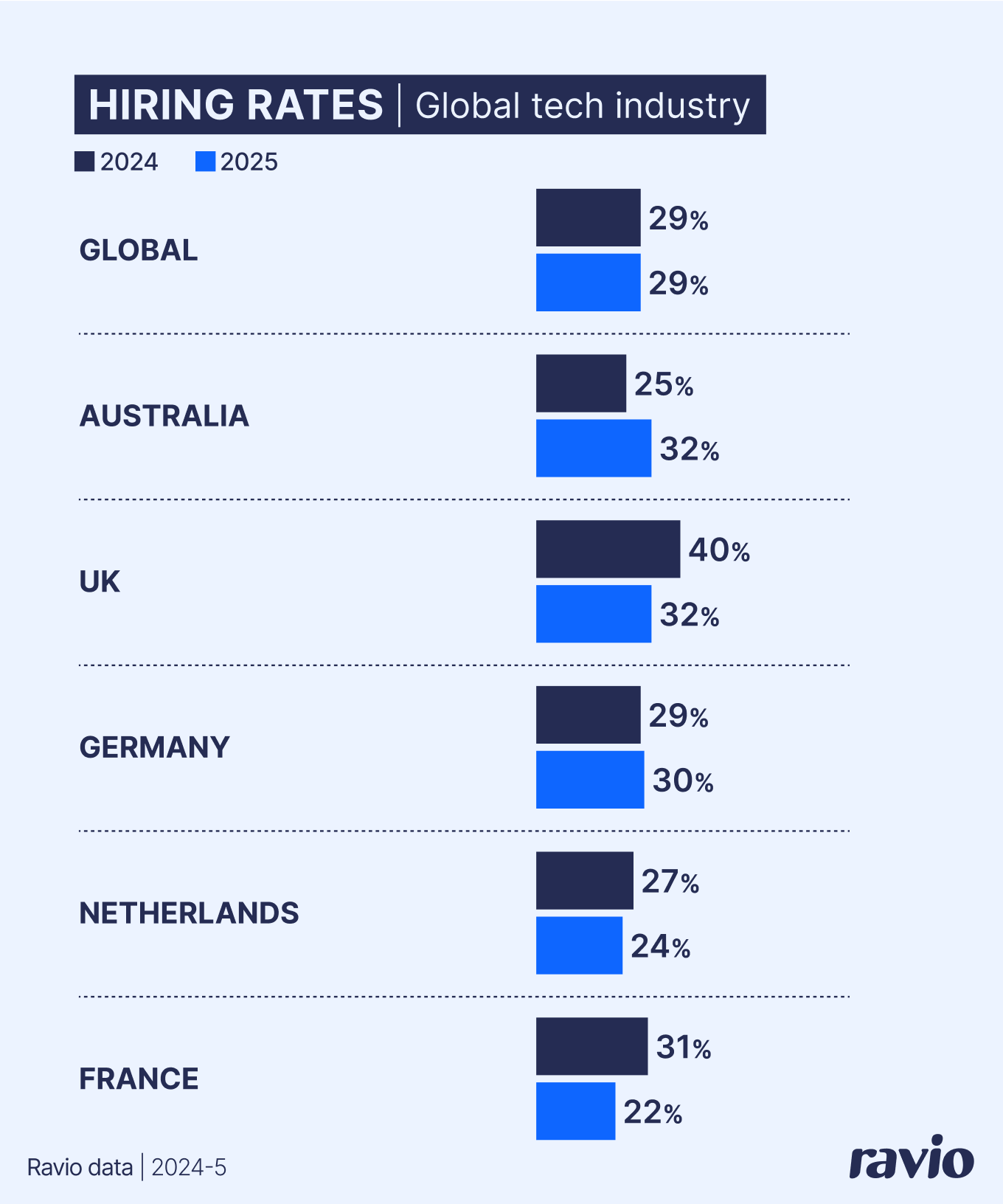

Our data shows hiring rates (proportion of new hires in the workforce in the last year, compared to the average headcount) in Australia are at 32% this year – a 30% increase from last year's 25%.

To put this in perspective, overall global hiring rates have stayed consistent, at 29% last year and this year, giving Australia higher than average hiring rates.

And, if we look at the European tech industry in comparison, we can see that most of Europe’s major tech hubs have seen significant reductions in hiring this year and have lower hiring rates than in Australia – like the Netherlands where hiring rates are down by 13% this year (24% vs 27% last year) or France where hiring rates are down 28% (22% vs 31% last year).

The Australian workforce is bucking the trend.

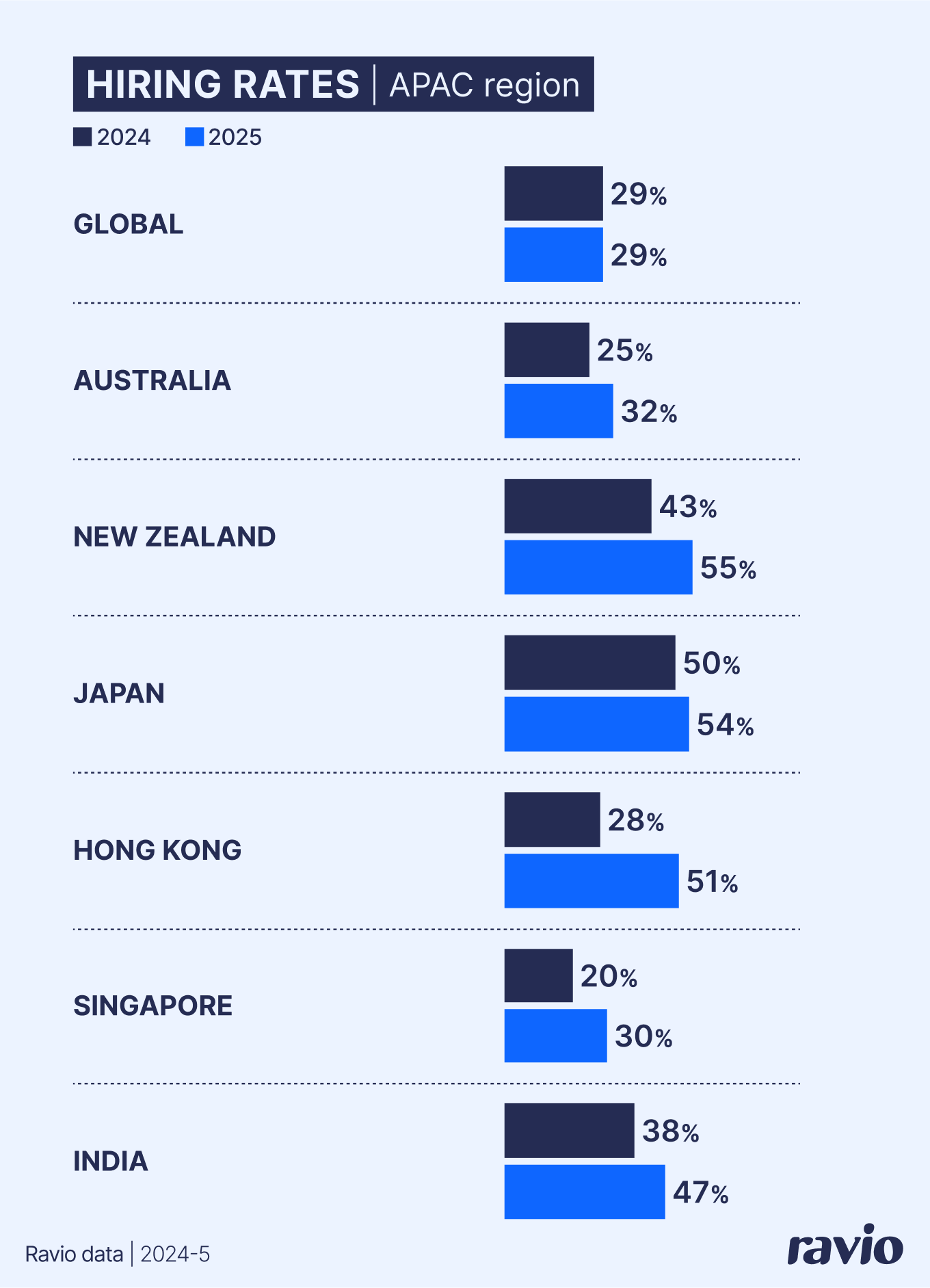

But this hiring surge isn't unique to Australia.

Across the APAC region as a whole, Ravio's data shows some remarkably strong hiring rates – like New Zealand at a 55% hiring rate, Hong Kong at 51%, or Japan at 54%.

The entire region appears to be in growth mode – and Australia actually sits at the lower end in the APAC context.

I can’t help but wonder if Europe’s approach to red tape and regulation at such an embryonic stage for AI focused startups is driving some of what we’re seeing play out in these numbers.

The APAC region contains deep talent pools at a discount to US and European equivalents, and many countries in the region are pouring investment into tech and AI, sweetening the deal further for companies to hire local talent.

But startups looking to tap into this talent pool need to do so cautiously.

When it comes to compensation and benefits, the region is diverse in approach to company culture and Rewards – which means what works here won’t always work there.

ANZ being slightly more mature startup environments tend to take strong cues from the US in my experience. Whereas I find South East Asia has more diverse variation. It pays to get local insights before trying to apply a foreign context and hoping it works.

The talent pipeline problem: Whilst hiring is high overall, demand for junior talent is down globally

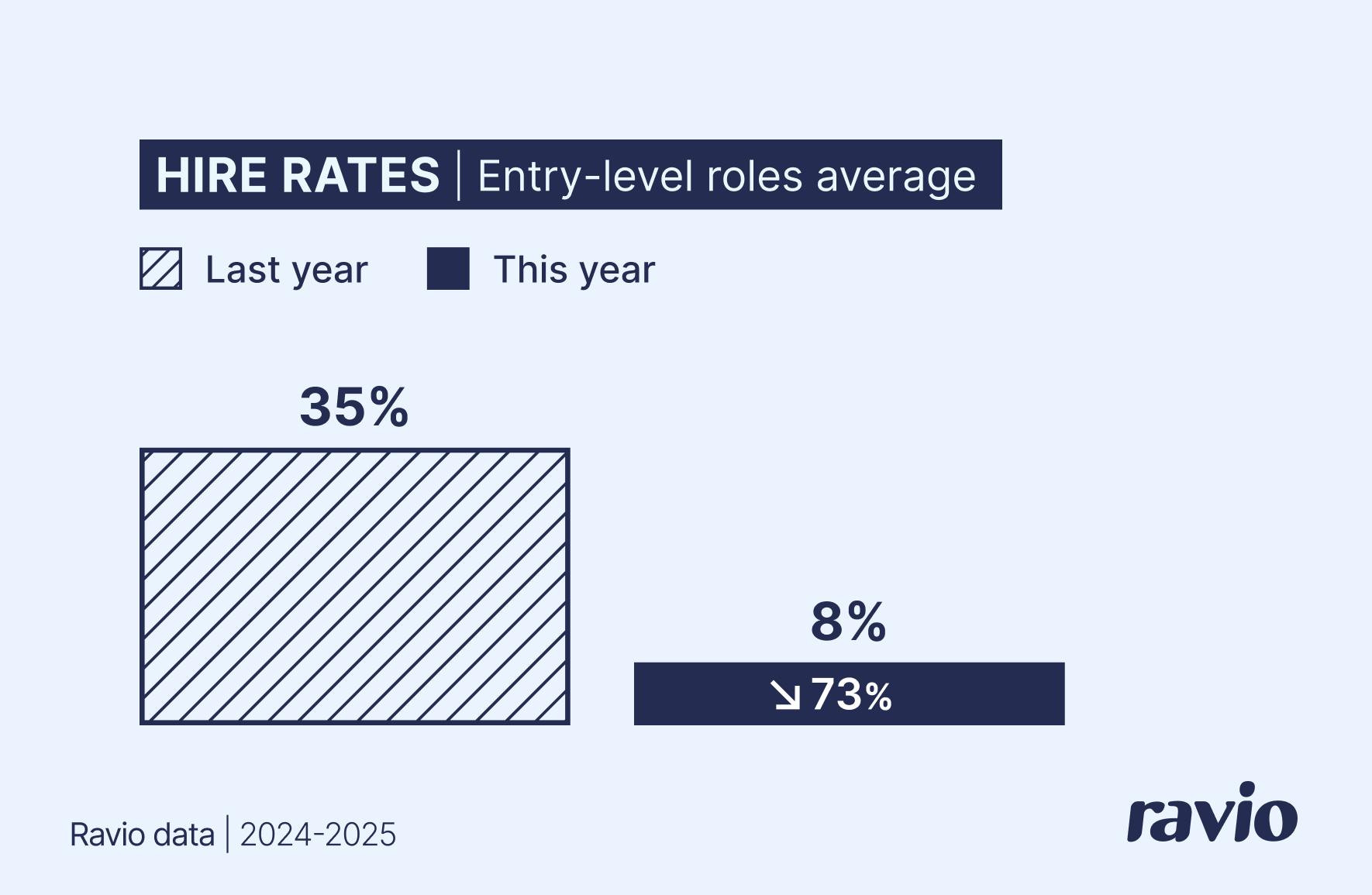

Whilst there’s a surge of hiring in Australia, it’s worth highlighting a concerning trend emerging at the entry level across the world.

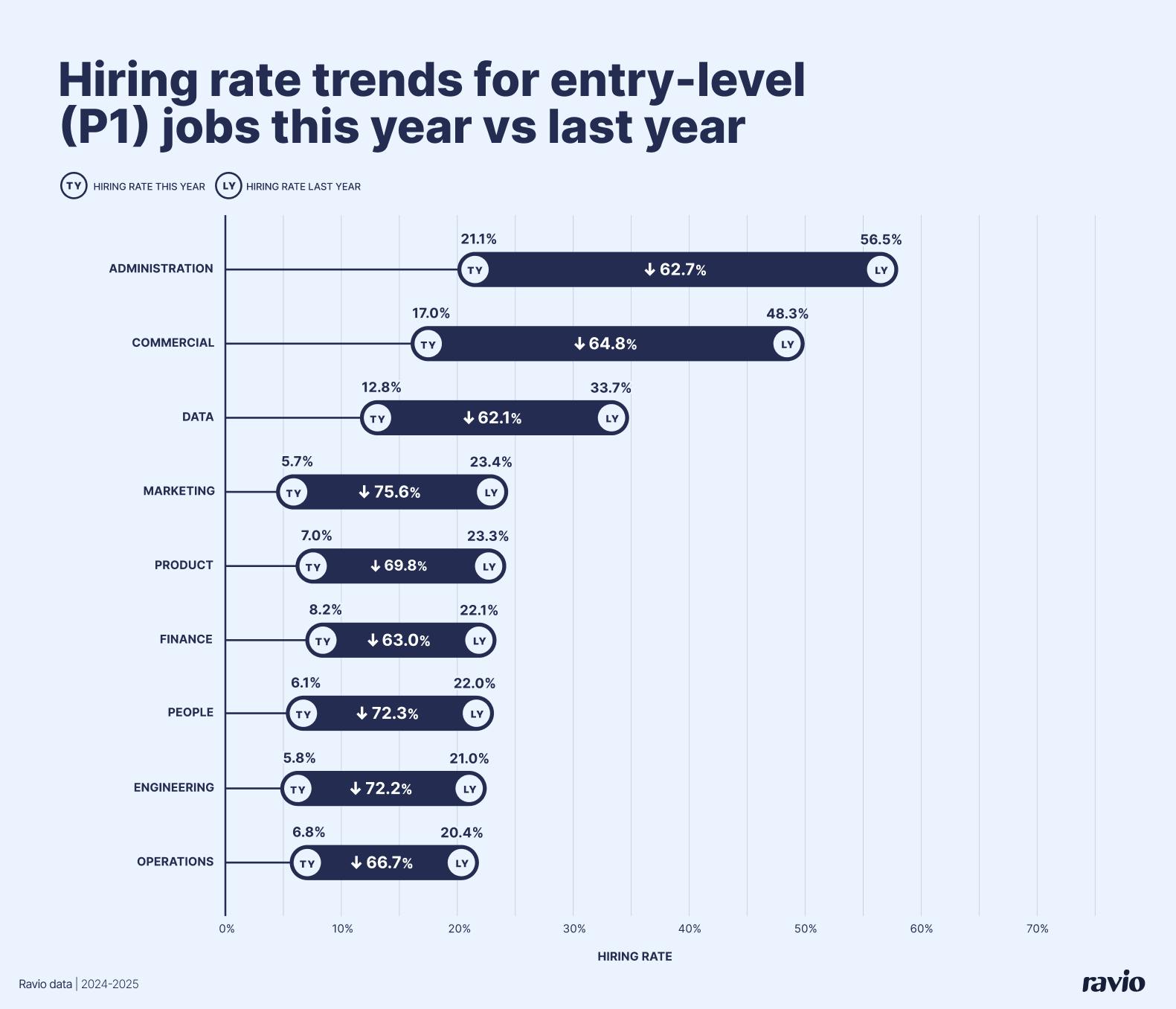

Globally, hiring for early career P1 and P2 roles has plummeted by 73.4% this year – down from a 35% hiring rate last year to just 8% this year.

The decline has hit Marketing teams, (5.7% hiring rate, down by 75.6% compared to last year), People (6.1% hiring rate, down by 72.3% compared to last year), and Engineering (5.8% hiring rate, down by 72.2% compared to last year) particularly hard.

The main reason for this is the growing integration of AI in the workforce, with entry level roles – as well as administrative roles too – particularly impacted due to the higher proportion of support or coordination-focused tasks that AI tooling is now able to automate.

At the same time, we’re of course also seeing a huge surge in hiring for AI roles and skillsets in the tech industry globally, with AI roles also seeing on average a 9.5% new hire salary premium compared to their non-AI counterparts.

This move isn’t surprising and is echoed by just about every major survey I see.

I expect every board of directors in the world is asking how AI is being adopted in order to improve measures like revenue per employee. I’m certainly seeing the question come up in my work with various organisations.

But with junior roles diminished, I expect sustained upward salary pressure on the mid-levels (without juniors to replenish).

I’m asking clients if they can afford to continue to operate in that kind of inflationary environment, or if talent strategies need to evolve to capitalise on hiring and developing the increasing supply of junior talent.

Of course, the flip side to this is how you’ll keep those same people when they inevitably become highly prized as the middle level hollows out from a lack of supply in a few years time.

Attrition rates in Australia in 2025: Talent is on the move

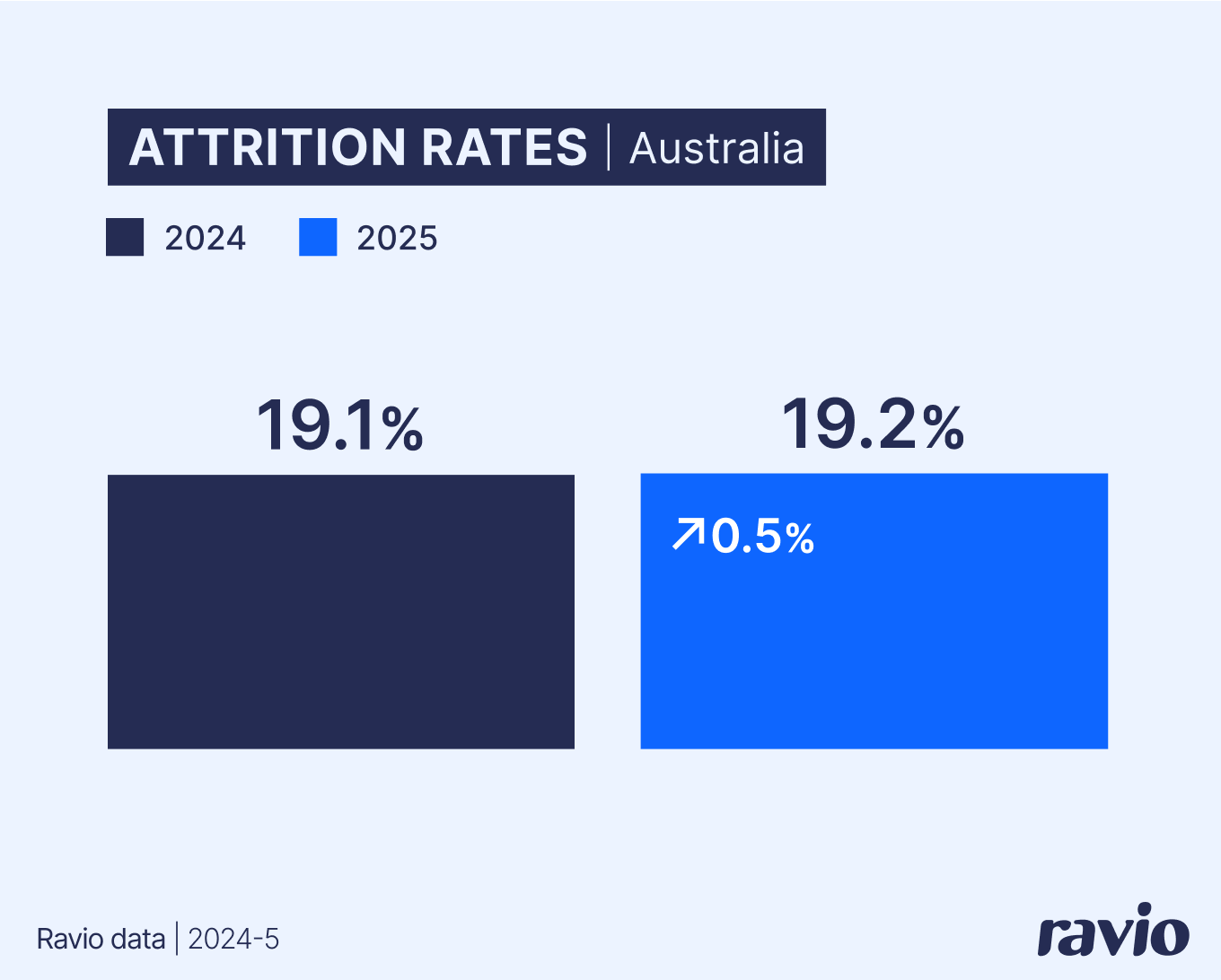

Retention in Australia's startups is stable this year, with the attrition rate (the proportion of employees who have left a role in the last year) sitting at 19.2% this year – virtually unchanged from last year's 19.1%.

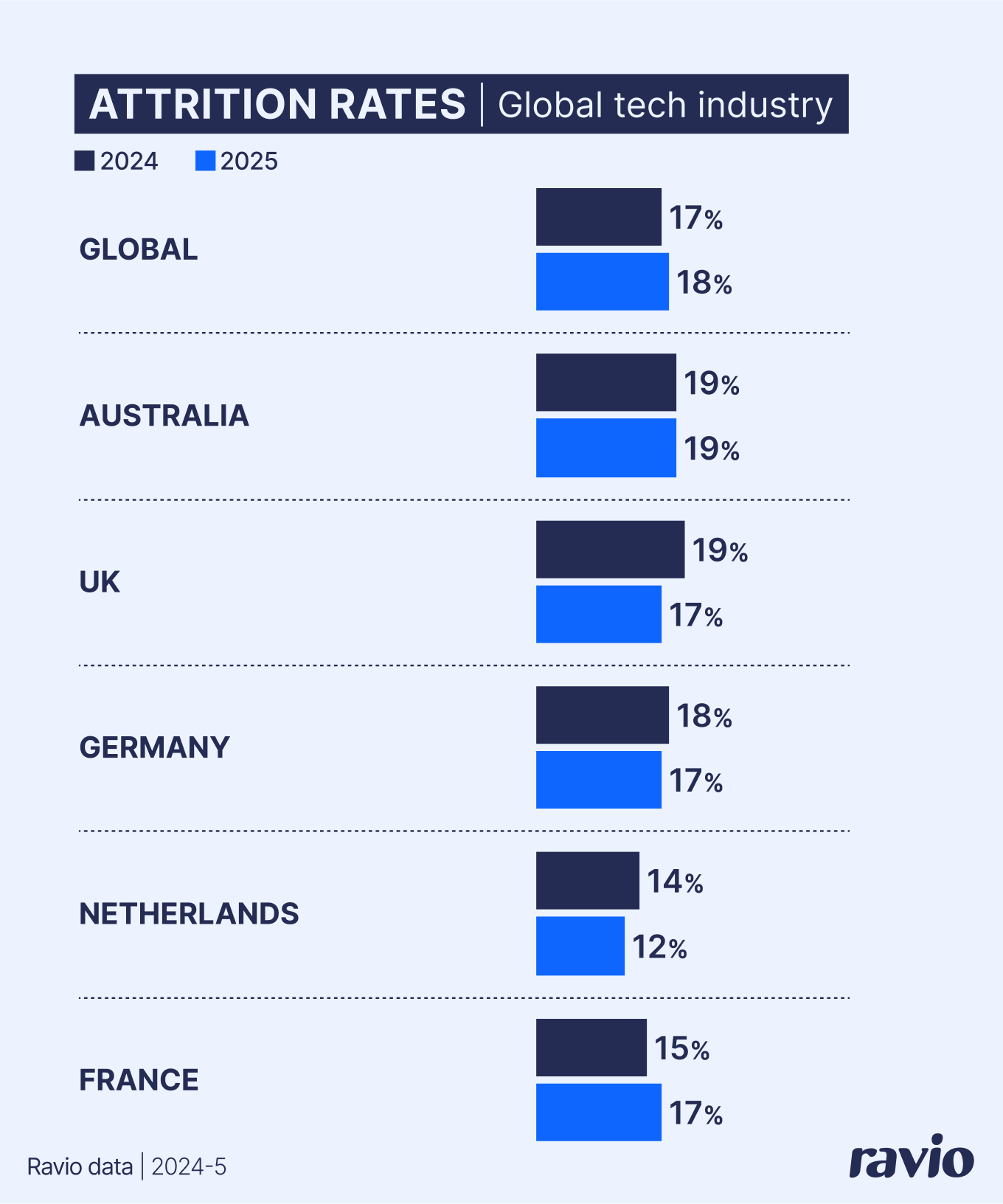

This stability might seem positive at first glance, but it actually puts attrition in Australian startups slightly higher than the global average of 17% this year (slightly reduced from 18% last year) – and higher than all of our comparative tech hubs across Europe, with the Netherlands (14% attrition rate) and France (15%) seeing particularly lower attrition.

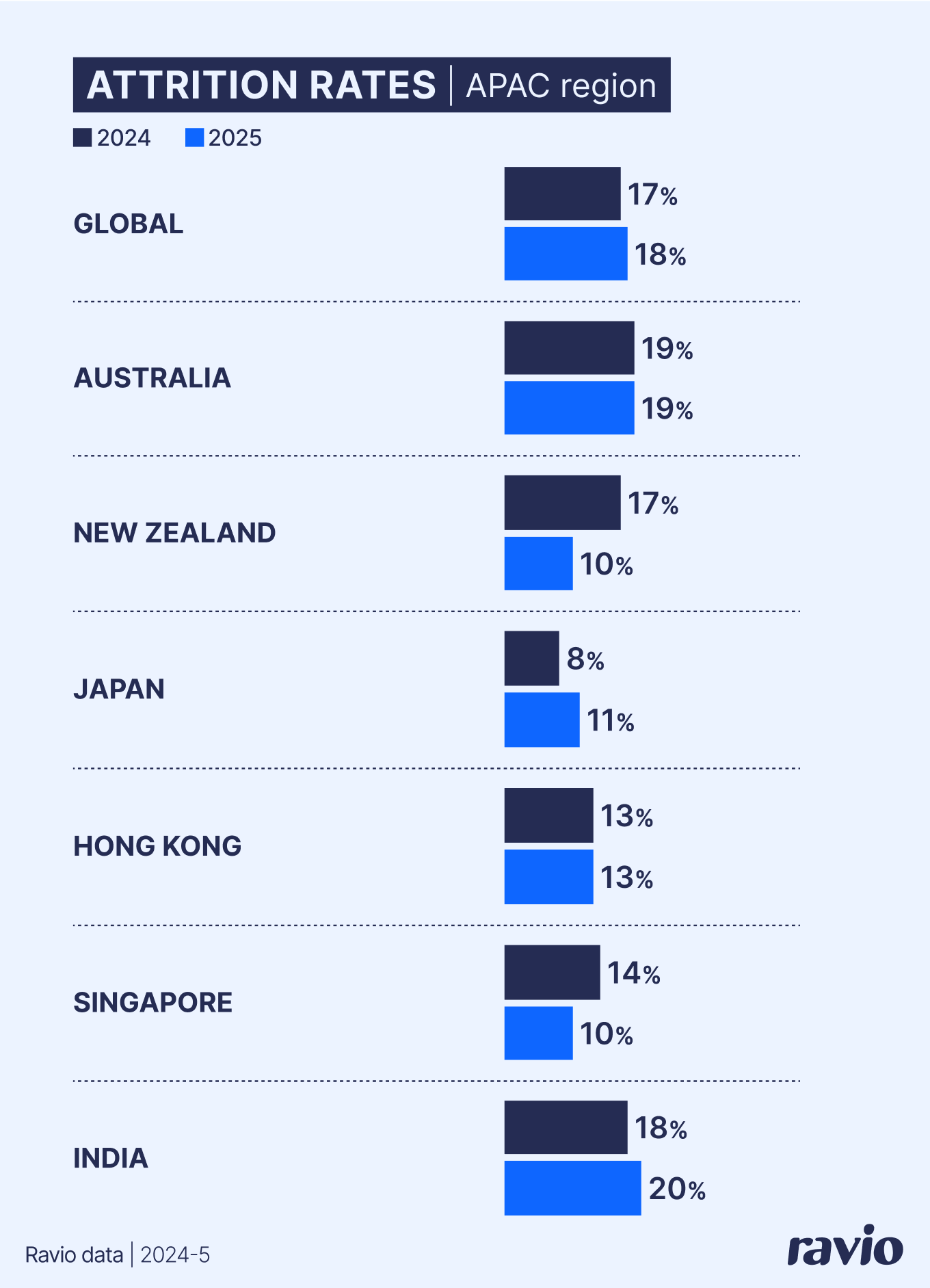

The same is true if we look at the APAC region, with Australia's attrition rate considerably higher than most of its neighbours, with the exception of India.

New Zealand (10% attrition rate), Japan (11% attrition rate), Hong Kong (13% attrition rate), and Singapore (10% attrition rate) all have very low levels of employee attrition compared to other markets.

Given we also saw that several of these markets (New Zealand, Japan, Hong Kong) have very high hiring rates this year, we may expect to see a talent squeeze in these markets – with high demand for talent but a small talent pool as employees favour staying put in their existing roles.

Australia’s attrition rate is the flip side of its hiring boom. Talent is on the move, and global firms are lining up to grab it.

Yes, there’s still wariness in the air after high-profile layoffs – even in “safe” sectors like banking. But the data shows people are cashing in, jumping ship for bigger salaries and better deals, and it looks like Aussies are more open to this than elsewhere in the region

Some of this is pent-up demand: intent to leave has been bubbling for years.

And the incentive to move is obvious – most professionals see a bigger pay bump after changing jobs vs if they stay put.

In a cost-of-living crunch, with loyalty running thin on both sides, missing market pay is an open invitation for your talent to start shopping.

Average salaries in Australia in 2025: What does fair and competitive compensation look like for Australian startups?

Looking at Ravio’s location differentials for a handful of global tech hubs compared to Australia, we can see that Australian startup salaries in 2025 sit somewhere in the middle in comparison to the world’s salaries.

US salaries are much higher than Australia’s, with a 1.50x location differential (Australia as the base at 1.0x). But India’s salaries are much lower, with a 0.48x differential.

In the middle lies Australia and Europe’s tech hubs – the UK has slightly higher salaries than Australia at a 1.10x differential, but Germany and France have slightly lower salaries than Australian startups at 0.96x and 0.85x respectively.

Location | Location differential compared to Australian salaries |

|---|---|

Australia | 1.0 (base) |

US | 1.50x |

UK | 1.10x |

Germany | 0.96x |

France | 0.85x |

India | 0.48x |

Singapore | 1.04x |

Taking Software Engineering as a specific example, the median salary for a P3 (mid-level individual contributor) Software Engineer in Australia is currently AU$138,000 (Ravio benchmarks, September 2025) – very similar to the UK (AU$143,000), Germany (AU$135,700), and Singapore (AU$142,600), with more variance elsewhere.

Location | Median salary for a P3 Software Engineer (AU$) |

|---|---|

Australia | AU$138,000 |

US | AU$228,100 |

UK | AU$143,000 |

Germany | AU$135,700 |

France | AU$120,200 |

India | AU$56,600 |

For Australian tech startups, these benchmarks raise critical strategic questions on both overall market positioning and location-based approaches.

Given the high demand local talent market we've already identified, is competing purely on base salary even sustainable? With US companies able to offer 50% salary premiums, European markets providing talent at similar costs, and some much lower cost talent opportunities within the APAC region, where should you compete? And how do you balance cost optimisation with the complexities of multi-location operations?

It’s clear that companies are increasingly assessing global talent and landing in the APAC region. The appeal for US companies is apparent, they can pay less and be more competitive in this region. For Europe, while base salaries may be similar, the discount on overall cost of employment and a comparatively less complex industrial relations environment make the region appealing.

That being said, I’m not seeing ‘US salaries’ for any but the best of top Australian talent, so companies shouldn’t get caught up in an arms race just yet.

Australia has a healthy startup ecosystem with strong investment. I’m increasingly seeing startups compete with more established industries on salary, and I no longer see the old adage of startups being ‘cash poor and equity rich’ in their offers. Many are serious competitors for talent now when it comes to cash compensation.

Australian companies looking abroad might be tempted by the significant discount in places like India, however need to be cautious not fall prey to a false economy. In some companies I’ve seen a tendency to burn through remote offshore salaries because they didn't invest in proper onboarding and cultural integration.

Pay equity in Australia in 2025

Australia's tech startups show a mixed picture on pay equity.

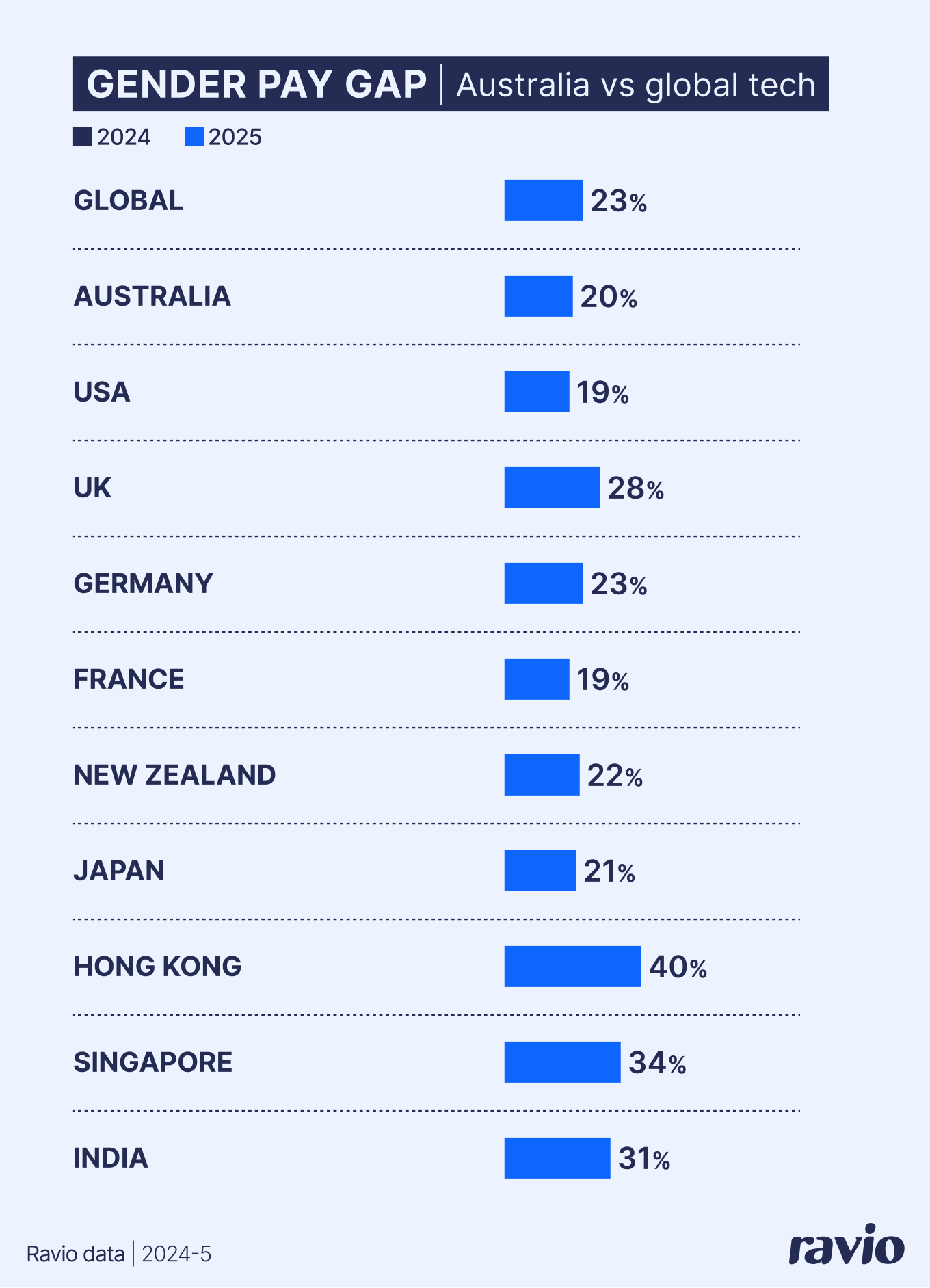

The median unadjusted gender pay gap in Australia sits at 20% in 2025.

This is a slightly smaller gap than the global tech average of 23%, and notably the lowest across the APAC region where gaps range from 22% in New Zealand to over 40% in Hong Kong.

Naturally, there are also variances across job functions, with the highest gender pay gaps in Australian startups seen in IT (43%), Finance (27%), and Product (23%), and the lowest gender pay gaps in People (-19%), Marketing (-7%), and Project Management (0.5%).

However, this relative strength shouldn't overshadow the work still needed in Australia, and worldwide, on pay equity.

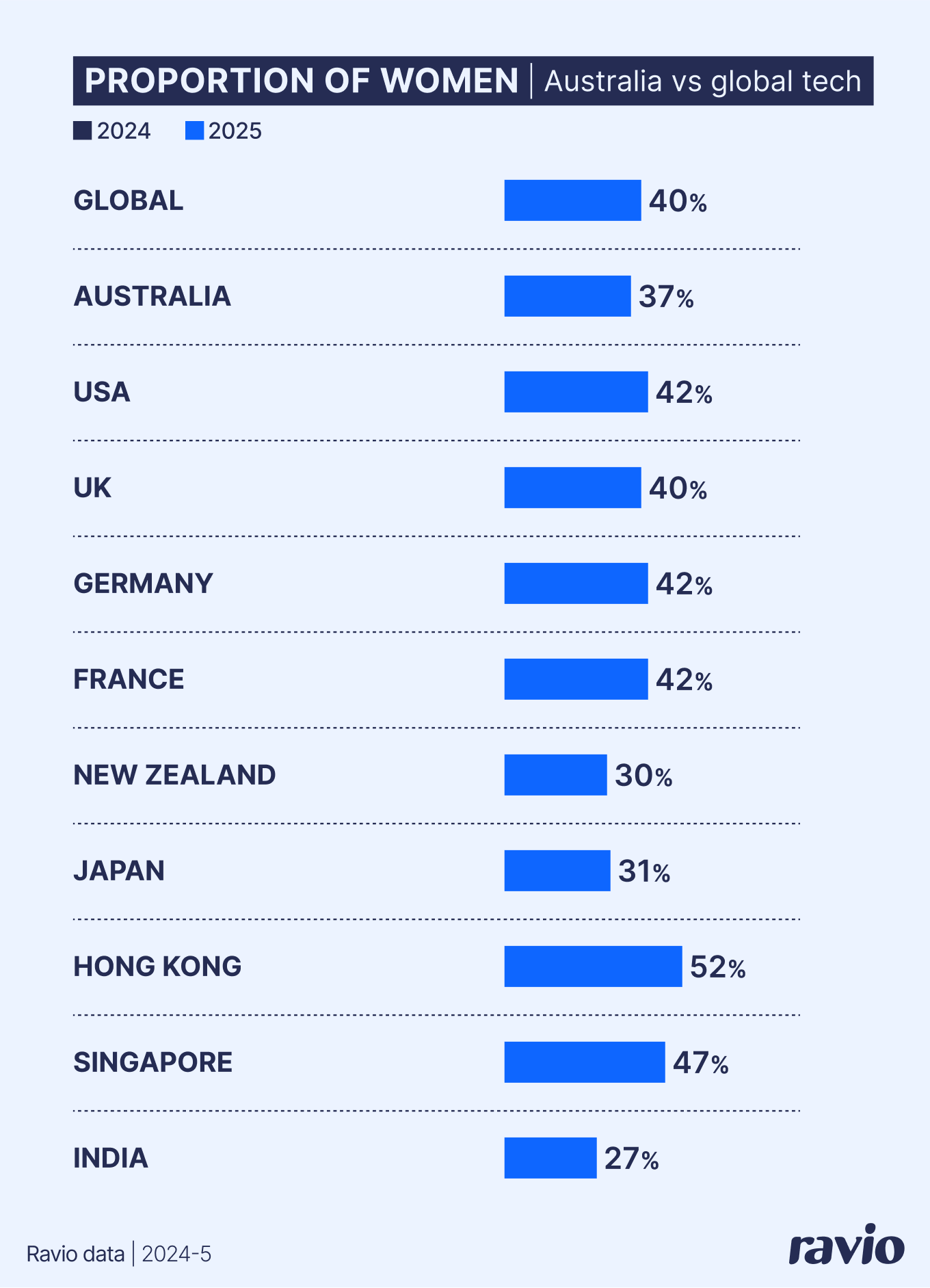

One of the biggest factors contributing to the gender pay gap in tech is the low proportion of women in the tech workforce overall, and particularly at senior levels.

Women make up just 37% of the tech workforce in Australian startups, sitting below the global average of 40% – but notably higher than several tech hubs across the APAC region, like New Zealand just 30% of the workforce being women, and India where it’s 27%.

The gender pay gap in Australian tech startups is narrowing too slowly to defuse the risk it poses to growth.

Globally, the technology sector has always struggled with balanced gender representation, and nowhere is that more visible than on pay. Progress feels slow because it is: Australia is only just beginning to require disclosure for companies with more than 100 employees.

But surface reform without structural change leaves the underlying pay dynamics untouched.

In Australia today, Workplace Gender Equality Agency (WGEA) reporting has exposed the persistence of gaps, but those numbers rarely shift how talent is attracted or retained. Pay is still negotiated at the individual level, not assessed against its relationship to the wider workforce. Boards are starting to push harder on pay equity, but most companies stop at monitoring the adjusted gap. Few interrogate the systems that create it – promotion pipelines, performance reviews, and detailed analysis necessary to identify who gets rewarded and why.

The question isn’t whether startups can attract women into the workforce; many already do. It’s whether they can keep them once employees see that career progression stalls and pay growth lags peers who move elsewhere. Attrition of experienced women will remain the quiet threat in an already squeezed market for mid-senior talent.

My prediction: The continued stubbornness of this gap will see Australia follow in the footsteps of the EU and US by introducing pay transparency legislation, which I expect will happen via the WGEA.

Key takeaways: What these trends mean for your hiring plans and compensation strategy

The data reveals several critical dynamics shaping the Australian tech market.

Hiring rates have jumped 30% while attrition remains stable at 19%, creating increased competition for available talent. Add the 73% global decline in junior hiring, and companies face both immediate talent competition and future pipeline challenges.

Australian salaries now match European tech hubs while sitting 50% below US rates and 50% above more cost-effective markets like India – making location strategy a key factor in talent and compensation planning.

Plus, progress on gender pay equity, while ahead of regional averages, still requires focused attention with a 20% gap remaining.

Most importantly, the pace of change in hiring patterns, AI adoption, and salary movements means People and Reward leaders need continuous visibility into compensation trends to stay competitive – whether adjusting offers to win critical hires or preventing key talent from being poached.

In this environment, reliable benchmarks and live market intelligence become essential for making proactive rather than reactive compensation decisions.

FAQs

Are salaries higher in the UK or Australia?

In the tech industry UK salaries are slightly higher, with a 1.10x differential compared to Australia. For example, a P3 Software Engineer earns AU$143,000 in the UK versus AU$138,000 in Australia (Ravio data, correct as of September 2025).

What is a typical tech startup salary in Australia?

Salaries vary significantly by function, level, location, and company stage. Using Software Engineering as an example, a mid-level (P3) Software Engineer in Australia earns a median salary of AU$138,000 (Ravio data, correct as of September 2025).

What’s the job market like in Australia right now?

The job market in Australia in 2025 is highly competitive. Hiring rates are up 30% year-on-year to 32.3%, while attrition remains stable at 19.2% (Ravio data, correct as of September 2025). This combination means more companies competing for roughly the same pool of available talent.

What are the biggest talent and recruitment trends in Australia right now?

Three major talent and recruitment trends in Australia in 2025 are:

- Aggressive hiring across the whole APAC region (Australia's hiring rate jumped 30% year-on-year to 32.3%)

- A stable but relatively high attrition at 19.2% due to market uncertainty and employees focusing on security – creating additional competition for available talent.

- A 73% global decline in junior hiring as AI automates entry-level tasks and companies prioritise AI capabilities in hiring and compensation budgets.

What is the best option for salary benchmarking in Australia?

The best salary benchmarking tool is the one that meets your organisational needs – integrating with your HRIS systems and offering reliable salary and total rewards data for the industries and locations that are relevant for your strategy.

Ravio is particularly well-suited for Australian tech (or tech-enabled) companies, offering reliable, real-time data with strong coverage across the global tech market, including Australia. For companies hiring both locally and globally, it provides comprehensive benchmarks across all key markets. Unlike providers relying on annually updated third-party surveys, Ravio sources data directly from HR systems – ensuring accuracy and current benchmarks that reflect rapid market changes.