Should you grant equity compensation to all employees?

Who gets equity in a company?

Equity compensation is an important tool for hiring and retention, especially for startups who are less able to compete with established companies on salaries.

But, equity isn’t always offered to all employees.

Some companies only offer equity compensation to senior leaders or to select roles – maybe it’s reserved as a negotiation strategy to close priority new hires.

Other companies only grant equity to the first handful of hires to recognise the risk those people are taking by coming on board in the very early days of a startup’s journey.

In this article we’ll take a look at Ravio’s benchmarking data to find out whether it’s common for European companies to offer equity to all employees, as well as exploring the key considerations that go into deciding what approach is right for your company.

Subscribe to our newsletter for a monthly treasure trove of insights from Ravio's compensation dataset and network of Rewards experts, to help you navigate a career in compensation 📩

Do startups typically offer equity compensation to all employees, or only select roles?

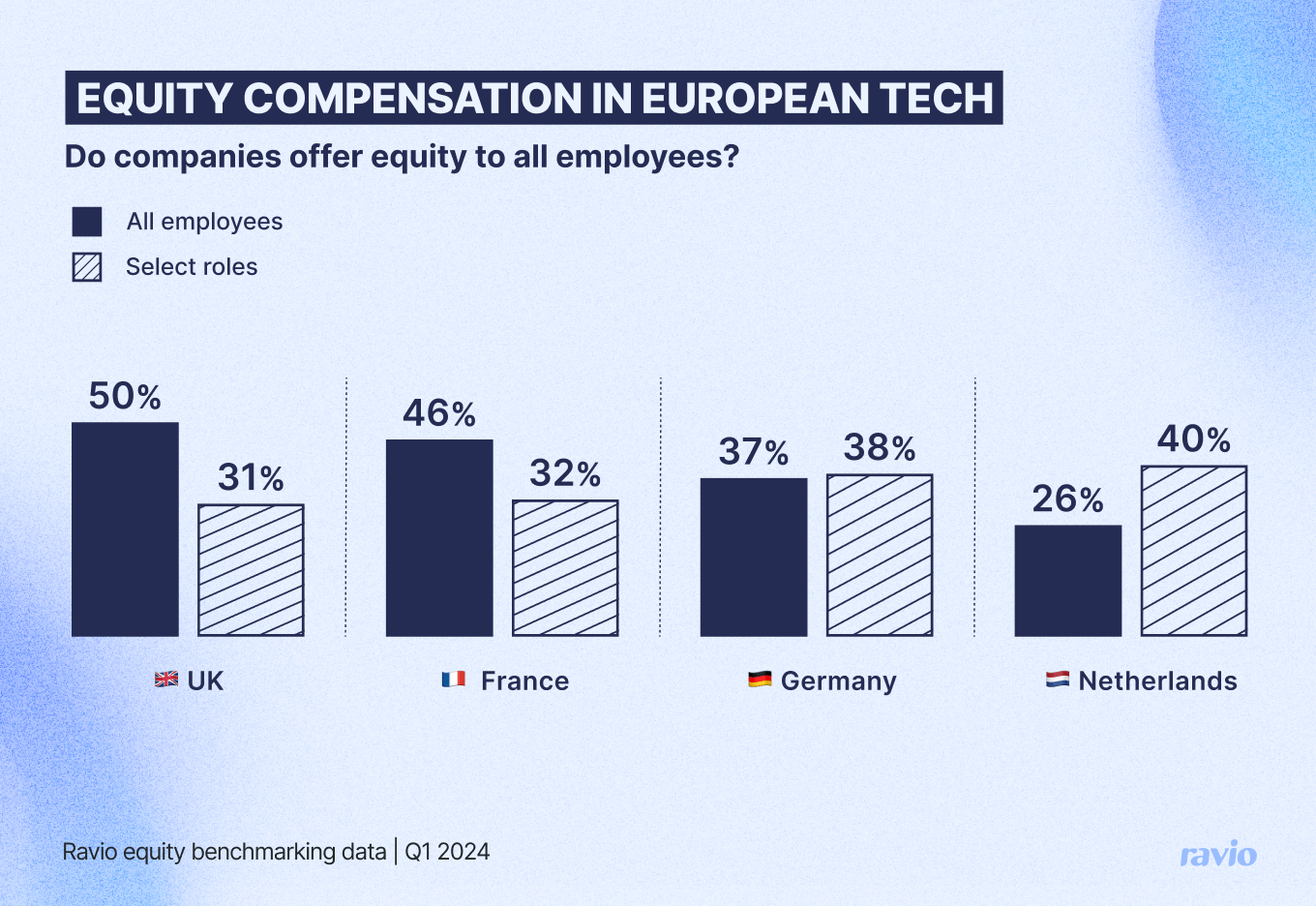

The answer to whether it is typical for startups to offer equity compensation to all employees actually varies significantly depending on where companies are based in Europe.

Let’s take a look at a few key hubs for the European tech industry to highlight this point (all data from Ravio, correct as of Q1 2024).

In the UK, 50% of companies offer equity compensation to all employees whereas 31% only grant equity to select roles (which includes those only granting equity to founders and leadership) and 20% don’t offer equity as compensation at all.

It’s a very similar story in France, where 46% of companies offer equity compensation to all employees and 32% only to select roles.

But, over in Germany employees are less likely to receive equity compensation, with 37% of companies granting equity to all employees and 38% offering equity only to select roles.

And this is further enhanced in the Netherlands where only 26% of startups offer equity compensation to all employees (40% only to select roles, and 34% don’t offer equity compensation at all).

It’s common for startups to offer equity to all employees

Generally speaking, we can see that it’s pretty common for tech startups in Europe to offer equity compensation to all employees.

Equity is a vital compensation lever for hiring for startups, who typically aren’t financially able to compete on salary offers with more mature, established, public companies – which explains why we see so many startups including equity in their total compensation package as standard for all team members.

Equity seems to be particularly common as a part of total compensation in the tech sector.

This is likely because of the maturity of the tech ecosystem, and especially the large number of successful startup exits in the tech industry which have resulted in large payouts for employees from their equity compensation – names like Shopify, Etsy, Zoom, Airbnb, and so on. In industries where there is less precedent for meaningful exits, very few employees will have seen their equity convert into cash and, therefore, may be less impactful as compensation.

And it’s a great compensation lever for employee loyalty and motivation at both startups and public companies too. At startups, employees are motivated to build a successful company, as they will be rewarded with a share of the profit if the company reaches a successful exit. At public companies this still stands, because if the share price stays strong them equity compensation is financially valuable to employees.

This is especially true at the moment.

It’s been a tricky few years for hiring and retention – rapid hiring and growth during the pandemic years, followed by mass tech layoffs and a much-slowed VC funding and IPO scene.

In our own 2024 Compensation Trends Report we found that hiring rates are down by 50% in the tech sector, and People Teams are making employee retention a priority this year as startups aim for cautious and sustainable growth in a difficult economic environment.

Morgan Stanley’s recent report ‘The State of Equity Plan Management at Public and Private Companies’ includes the finding that HR and People Leaders see expanding equity compensation schemes to more employees as a top tactic for combatting employee attrition – the second most popular strategy behind salary raises.

Budgets are tight and most companies are seeking other means to attract and retain talent that do not directly impact their immediate cashflow – so equity is especially important right now.

But what about the variance across countries?

Government tax-advantaged schemes

One important factor in the variance across countries is government tax-advantaged schemes.

Many countries have tax-advantaged (for both employee and employer) schemes available to encourage companies to offer equity to employees, particularly for startups and SMEs to support their talent acquisition and growth.

This is true in the both UK with the EMI share option scheme and France with bons de souscriptions de parts de créateurs (BSPCE) – both locations where it’s more common to offer equity to all employees as part of their overall total compensation package.

The Netherlands, in contrast, does not have a tax-advantaged scheme available, which makes equity compensation a less attractive proposition for both employer and employee.

A legislation change from 1 January 2023, however, does mean that now employee stock options are taxed only at the point of sale in the Netherlands (previously they were taxed at exercise when converting them into cash value is still not guaranteed) which does make them slightly more attractive – so we may see an increase in the use of equity compensation in the Netherlands over coming years.

If not all employees, who gets equity?

Common approaches are to offer equity compensation to:

- Executive team only

- First hires only

- Specific job functions/roles only.

Granting equity only to executives

Some startups choose only to offer equity compensation to executives and leadership team employees.

This was actually once the norm, with equity seen as a perk for elite executives and directors.

In the 1990s/2000s the ‘dotcom boom’ led to employee stock options becoming a much more commonly understood and desirable form of wealth generation – with stories hitting the mainstream press of Google employees becoming overnight millionaires due to their stock options.

At the same time, RSUs became a much more popular vehicle for granting employee equity, which further democratised equity compensation as they hold less risk for the employee.

So during this time it became much more common for employees to be offered equity, which is why it’s less common today for only executives to receive equity.

But, it is still sometimes the case.

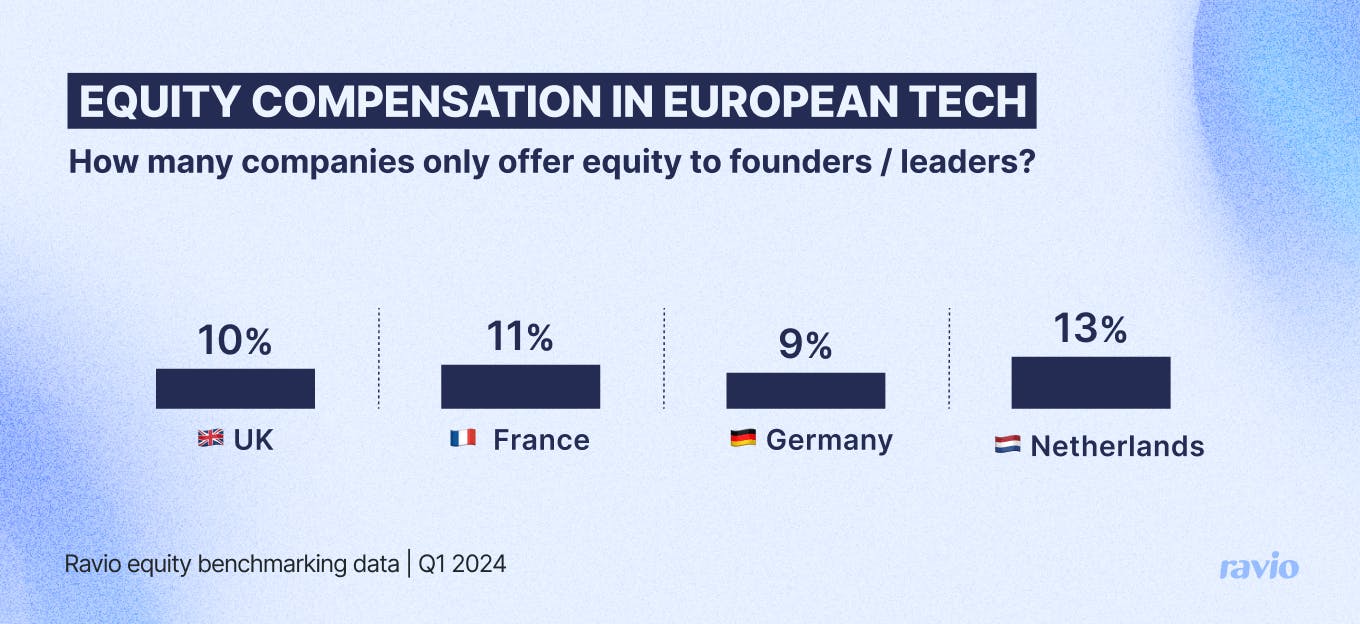

Looking at our equity data we can see, for instance, that 10% of UK companies only offer equity compensation to founders and leadership.

The Netherlands is the tech hub where this is most likely, with 13% of companies offering equity compensation only to founders and leadership.

Getting your management structure right is vital for the success of a startup, and offering equity compensation is an important strategy to get great leaders to onboard to the team.

On the other hand, this approach can damage the fairness of your company’s compensation approach, increasing the pay gap between top executives and all other employees.

Granting equity only to first hires

Just like it’s vital to get the right leadership team in place, the first few hires are vital for a startup’s success – shaping the trajectory of the product and setting the tone for company culture and ways of working.

At the same time, there can be a high amount of risk for the first hires to a startup.

90% of startups fail. Early hires have to weigh up that possibility, and the fact that they’re unlikely to receive a market-leading salary for a long while, before agreeing to join the company. They may also be leaving behind a great role – and may even be leaving equity on the table at their previous role, depending on their vesting schedule.

It’s common to balance out that risk with the reward of equity compensation which could have a high upside in the future if the company is successful.

Sometimes startups will give the first hires a set percentage of ownership in the company, in the same way as founders typically have. Often this is fairly arbitrary e.g. 1% of the company for the first three hires – but this isn’t advisable. Equity grants in this early stage should always be done on a case-by-case basis led by the level of risk the employee is taking by joining the team.

Granting equity only to tech roles

Some companies may have a compensation philosophy which places emphasis on certain job functions.

We regularly speak with tech startups who have a different approach to compensation for tech roles vs commercial roles, because these roles are fundamental to the direction of their company and/or because the job market for top tech talent is highly competitive. They might align with the 75th percentile for salary offers for these roles, to increase their competitiveness. And they might also offer equity compensation to these roles for the same reason.

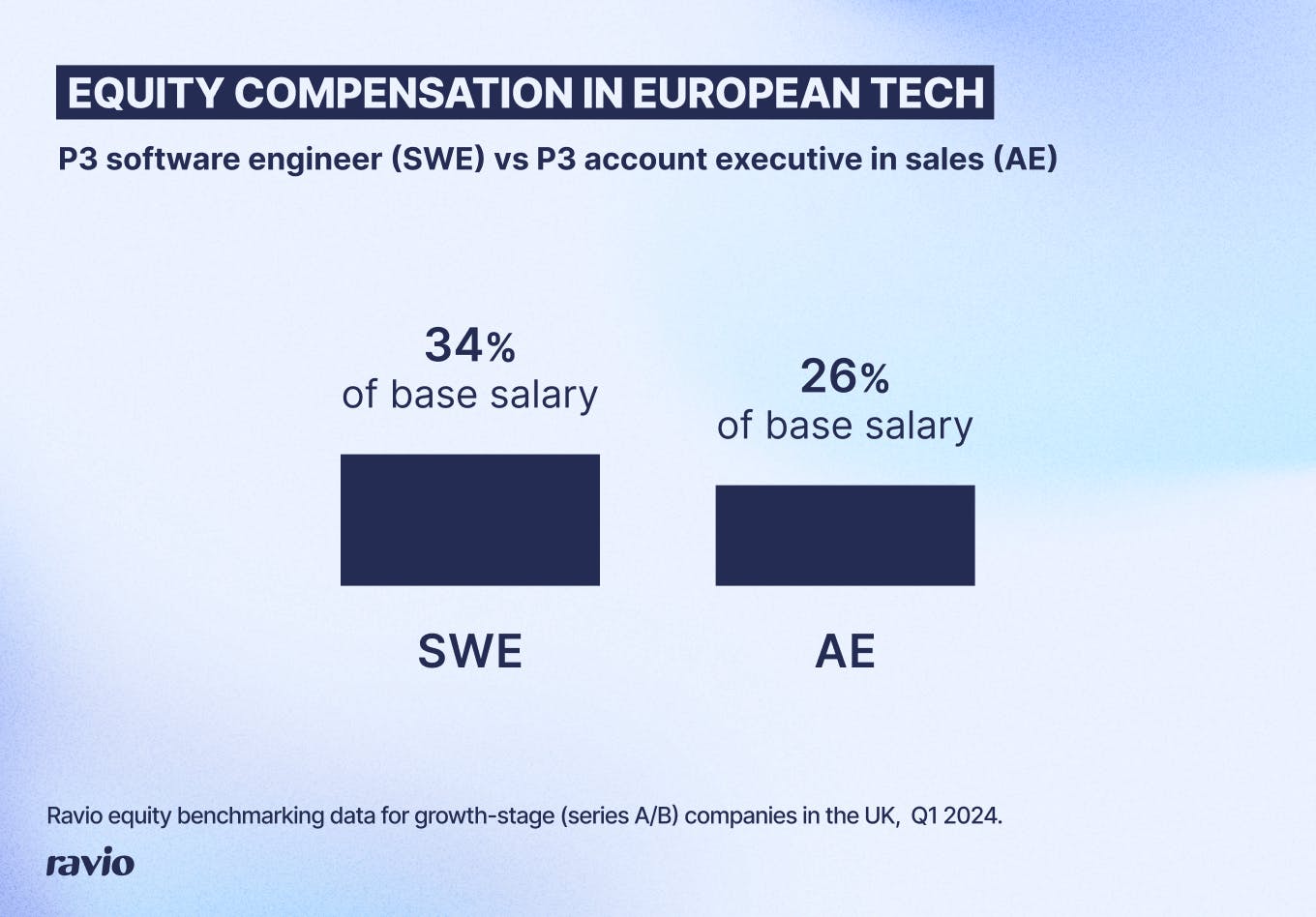

This is reflected in our equity benchmarking data at Ravio.

For instance, we can see that the typical grant for a P3 software engineer in a growth-stage startup is 34% of base salary (full grant value, vested over a standard 4 year vesting period), compared to 26% of base salary for a P3 account executive in sales.

So, who should get equity in your company?

So far in this article we’ve covered the key approaches in terms of who receives equity compensation within startups, including insights from our dataset on what is typical in the European tech market.

But how do you decide which approach is right for your company?

We spoke to Anna Ott, VP of People at HV Capital, to get an expert viewpoint on this question from someone who has supported countless companies to build high-performing teams.

Anna highlighted four key considerations for startup founders when deciding who gets equity in the company:

- Have clear rationale behind every equity grant

- Lead with fairness

- Be realistic about retention

- Consider an opt-in approach to equity compensation.

Have clear rationale behind every equity grant

Founders often see equity compensation for employees as something they simply have to do – all the successful startups they know of offer equity, so they should too.

What’s missing from this is the question: why?

Why should we offer equity?

Having a clear understanding of what you want to achieve with equity compensation informs which employees should receive equity. But, in Anna’s experience, it’s all too common for founders to be unable to answer that question.

Anna’s advice is to establish a company compensation philosophy early on.

That can start as a simple conversation with your co-founders to align on how you think about compensation, covering core questions like:

- How do we think about compensating employees?

- How do we think about rewarding high performers?

- How do we think about retention?

This will enable you to determine the guiding principles for how compensation works at your startup. Through this, it becomes much easier to see objectively how equity compensation aligns with what you want to achieve from your compensation approach, and to evaluate later whether equity compensation is achieving what you want it to – is equity actually helping us to onboard and/or retain top talent? With a well-defined compensation philosophy, who gets equity becomes a much more objective decision with clear rationale behind it.

“It’s never too early for a co-founder conversation on how you think about rewarding your team – including how equity fits into this. That conversation will become the backbone of your compensation philosophy. Without this structure early on, compensation decisions become very messy and will result in a lot of retrofitting later down the line.”

VP of People at HV Capital

Lead with fairness

The compensation philosophy that you develop should always be optimised for fairness, and that includes what is fair when it comes to which employees should be granted equity.

Typically, those who hold equity have a bigger voice within the company. C-suite leaders already have a huge amount of influence, and so only granting equity to executives could damage the fairness of your compensation structure.

Anna suggests focusing on how equity fits into the total compensation package for different team members.

Startups have a tendency to over-index on executive compensation and offer above-market salaries, especially those that are keen to win top leaders from the big players like Google or Meta. This means that C-suite leaders are typically already receiving disproportionate pay. Offering them equity compensation on top of this, whilst other employees have lower salaries and no equity, is only going to widen inequalities – especially given that there’s still a huge lack of diversity in leadership roles.

For Anna, a good sense check is to consider whether you would feel confident looking an employee in the eye and explaining the reasoning and principles behind their compensation and whether their role benefits from equity. If the rationale is there you should feel comfortable doing this. If it isn’t, there’s a high likelihood the employee will feel unfairly compensated, and that damages trust.

“Combining both pay and equity can create vast disparities between the top and bottom of your organisation. This needs to be balanced out: resources are always limited in startups and should be distributed with underlying principles and fairness at the core."

VP of People at HV Capital

Be realistic about retention

All founders think their first hires will be with them throughout the startup’s journey and to exit, and so often founders want to grant those early hires equity as a signal of this commitment and the idealistic view that they will be a key part of the journey.

In reality, that never happens.

Not all employees want to be with your company in 5 or 10 years time.

And it might turn out that you don’t want them to be there – roles, teams, and priorities evolve significantly throughout a startup’s life, and great-fit employees in the early days may not be a great fit throughout that journey.

Our Ravio 2024 compensation trends report includes the finding that the average tenure for an employee at a tech company in Europe is 1 year and 9 months, supporting this reality.

In Anna’s experience, most teams start with 2-3 founders and then build out their executive team over several years. In many cases, the C-level or VP level managerial layer isn’t installed until later in that process, as the business reaches a more advanced stage. So, if your focus is retention, loyalty, and reward, it may be more meaningful to grant equity to these key roles a little later on when you have a clearer view of the company’s trajectory and the team members who can take you there.

“No one is as committed to your startup as the founders. Early hires will always play a huge role in a startup’s journey, but it’s uncommon for them to stick around until IPO. Granting equity will never completely prevent churn – but that doesn't mean those employees are any less committed whilst they are with you.”

VP of People at HV Capital

Consider an opt-in approach to equity compensation

When deciding which employees to grant equity to, it’s also important to consider what employees actually value from their total compensation package.

Not all employees want to optimise for equity, some will prefer to increase their cash compensation. Because of this, taking a blanket approach to equity is never going to be optimal for hiring or winning employee trust and loyalty.

Anna suggests incorporating a mechanism to reflect this in your equity scheme, enabling employees to choose whether to optimise for cash or equity.

“Equity is not a litmus test for how much employees believe in your business or how loyal they are. There are many reasons why employees might want to optimise their compensation for cash over equity. Maybe they’re expecting a child or buying a house. Maybe they’re simply risk averse. Maybe they aren’t sure if this is really a five-year role for them. Whatever the reason, giving them the option can be a powerful approach.”

VP of People at HV Capital