Employee benefits guide: How to build a competitive package in 2025

Designing the right employee benefits package isn’t just about adding an endless list of perks.

It’s about making strategic choices that balance employee needs with the company's core values and with benefits costs.

Companies that strike the right balance don’t just win talent, but also help to separate themselves from competitors – especially nowadays, with employees looking beyond just salary – seeking flexible work, meaningful perks, and a company that aligns with their values.

In this employee benefits guide, we’ll explore everything you need to know about building a benefits package that strengthens your compensation strategy and helps your brand stand out.

📖 Table of contents

- What are employee benefits?

- Why are employee benefits important?

- The main types of employee benefits: mandatory, enhanced mandatory, optional, perks

- How to build a competitive employee benefits package: a step-by-step-guide

- How to budget for employee benefits

- 7 examples of employee benefits packages: Costco, Amazon, Google, Apple, Microsoft, Salesforce, Netflix

Subscribe to our newsletter for monthly insights from Ravio's dataset and network of Rewards experts, to help you navigate a career in compensation 📩

What are employee benefits?

Employee benefits are non-wage components of a total rewards package that organisations provide to employees. The number and range of benefits a company offers will depend on its location, industry, compensation approach, and budget.

Employee benefits are either mandatory (required by law) or optional, used to make a total compensation package more competitive in the market.

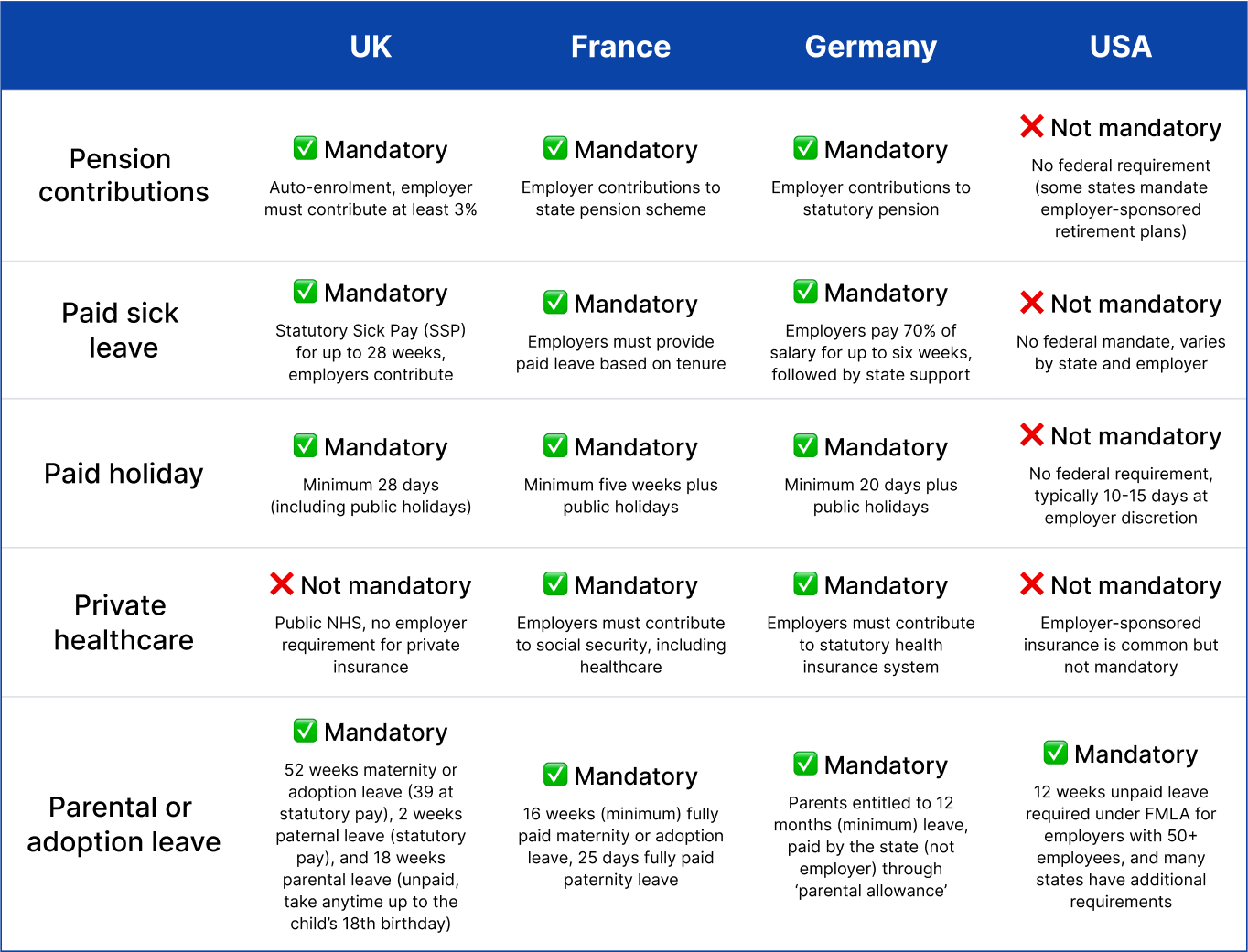

Mandatory benefits, otherwise known as statutory benefits, range across different countries but typically encompass benefits like pension contributions, paid sick leave, and health insurance.

For example, in the UK, all companies must offer statutory maternity and paternity pay and leave, adoption pay and leave, an opt-out pension scheme, and more. In comparison, employee benefits in France cover private healthcare and 50% of commuting costs.

When it comes to optional benefits, many organisations choose to enhance certain mandatory benefits, going above and beyond the statutory minimum for benefits like parental leave or offering unlimited PTO. Other optional benefits (sometimes known as perks or fringe benefits) could include free office lunches, professional development budgets, or flexible working opportunities.

Why are employee benefits important?

Employee benefits are an important addition to a total rewards package.

For employees, benefits can provide additional financial security, with offerings like stock options, commuter expenses, and gym stipends all helping to help people manage their money over time.

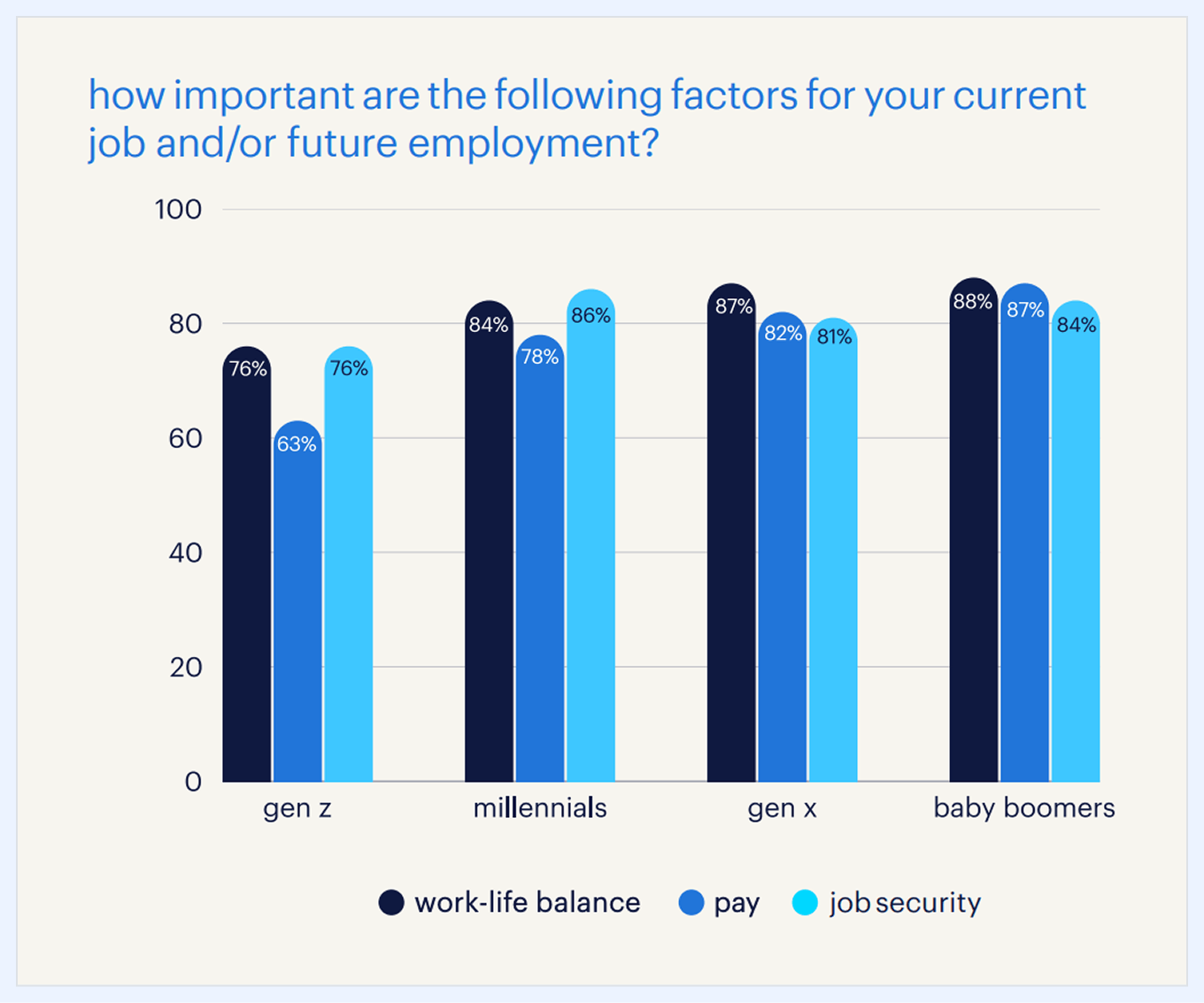

Employee benefits can also be crucial in supporting a better work-life balance – something that is particularly important for new generations of workers.

In fact, work-life balance was voted as a higher priority than pay for the first time in Randstad’s 2025 Workmonitor report across all generations.

For organisations, employee benefits play a crucial role in making a total compensation package more competitive, helping to set their brand apart by offering employees what they value most in a workplace beyond just salary.

This is vital for hiring, retention, and employee engagement objectives – ultimately supporting a productive and efficient team.

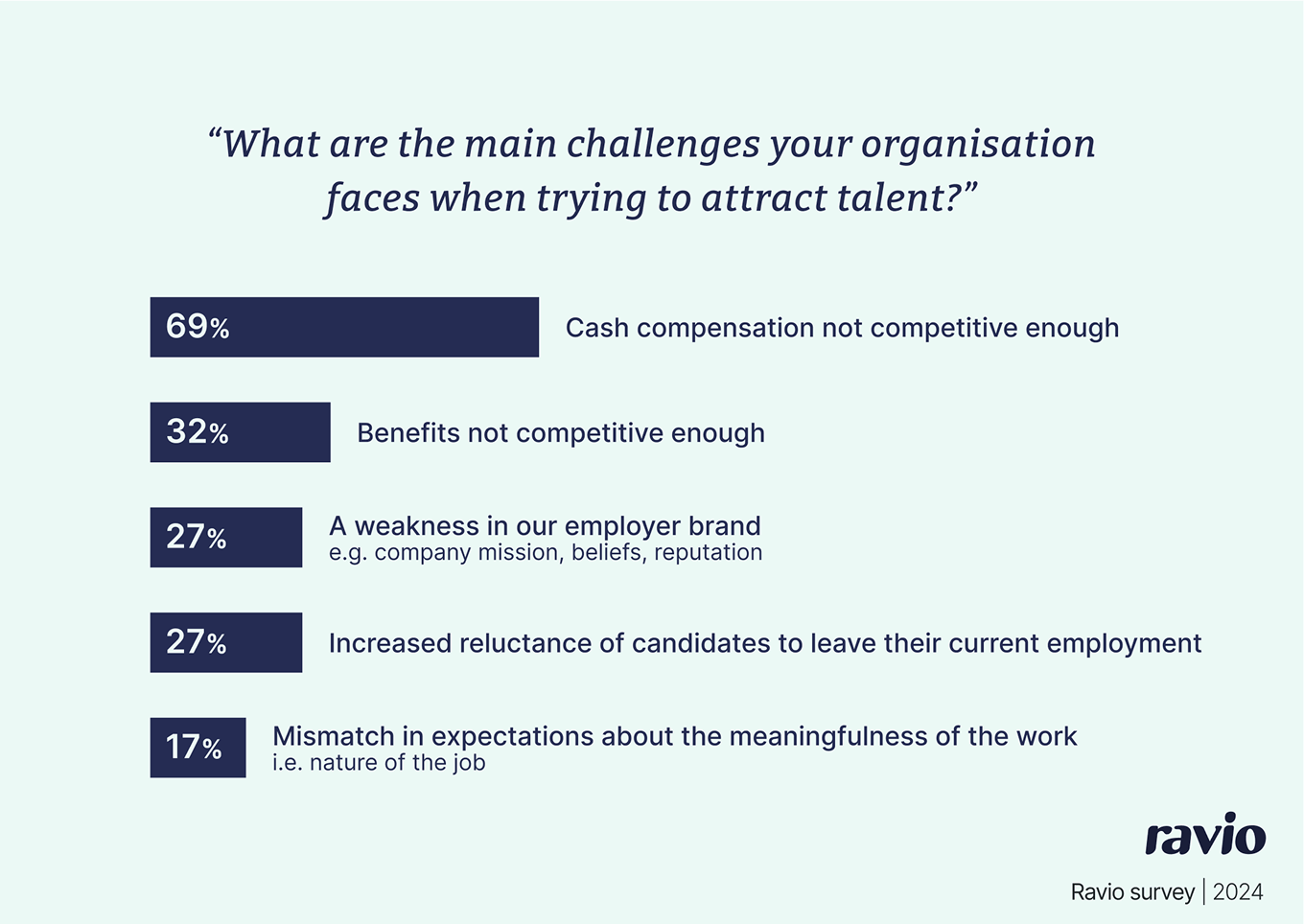

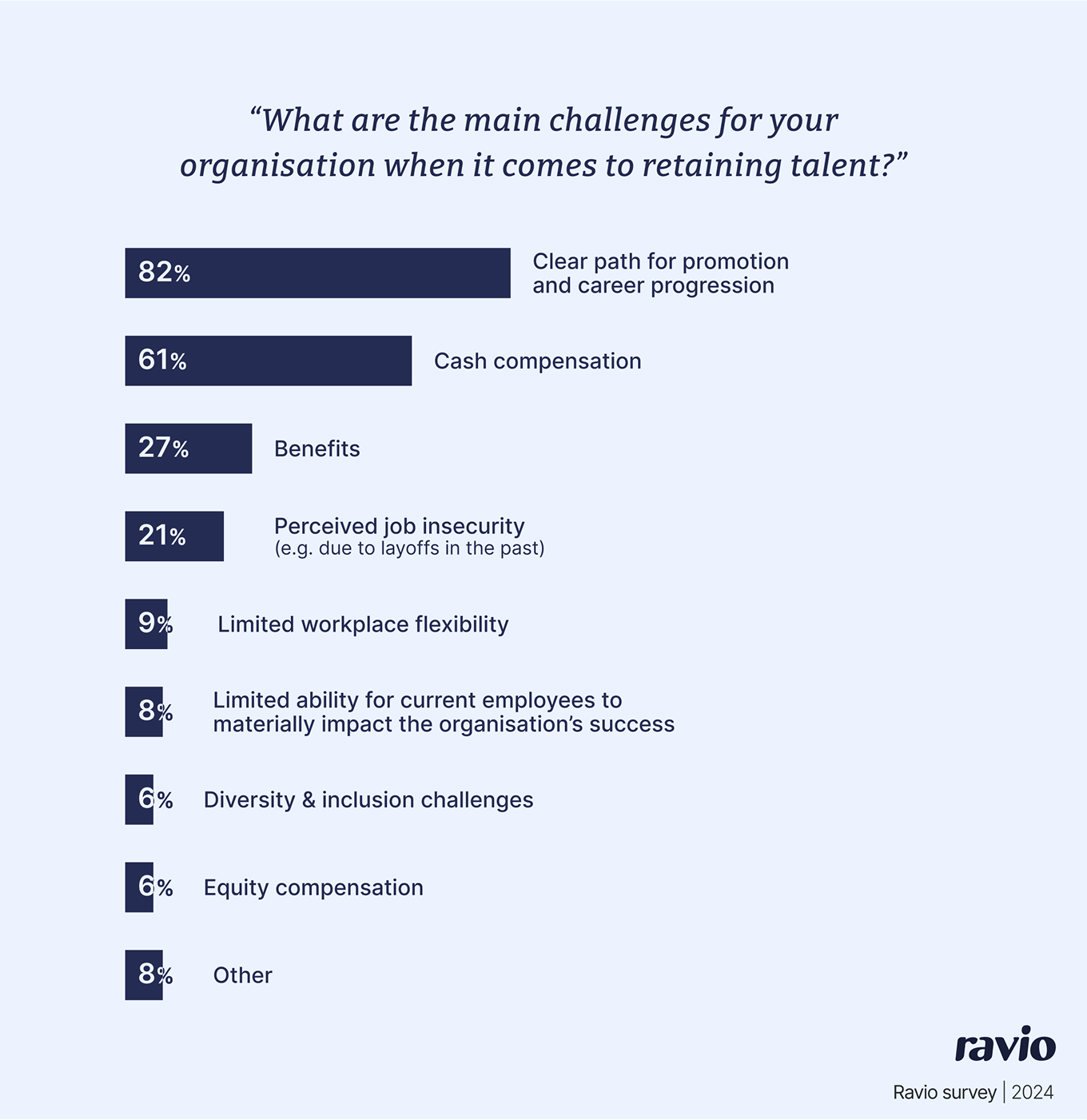

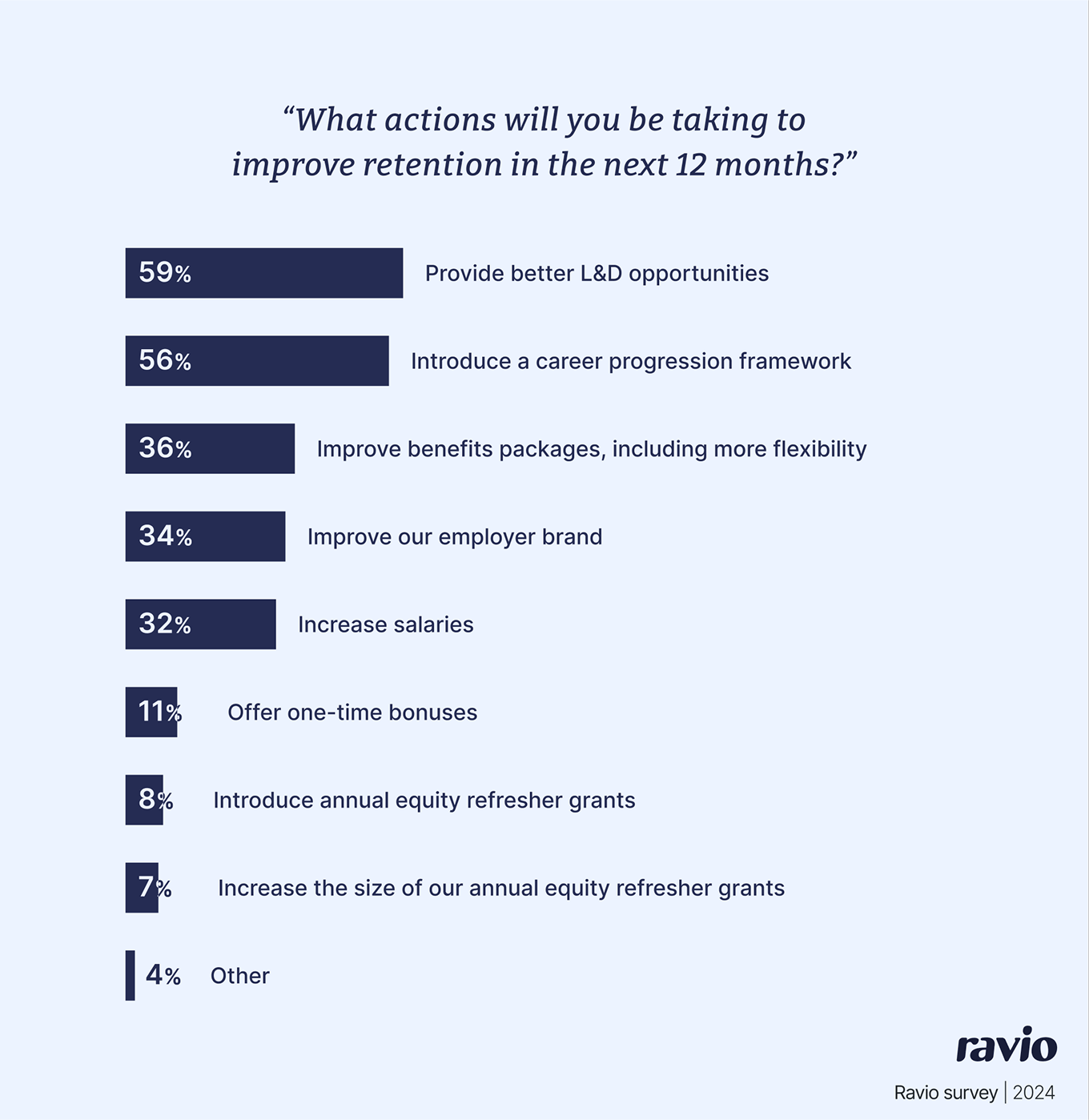

The importance of benefits is clear from Ravio’s latest compensation trends report.

32% of employers say their benefits package isn’t competitive enough when trying to attract talent – the second biggest challenge behind cash compensation.

When it comes to retaining talent, a similar issue exists.

27% of employers say benefits are the biggest challenge, behind promotion and cash compensation.

So it’s unsurprising that improving benefits packages is in the top priorities for improving retention in 2025 too.

At the same time, for employers the need to ensure compliance with mandatory benefits is also important due to legislative risk.

Here’s a summary of why employee benefits matter for organisations:

- Attract and retain top talent: Salary alone isn’t always enough, especially in competitive industries like tech. What’s more, companies can’t always compete on salary (especially early-stage startups with limited budget) so a strong benefits programme can make them stand out to potential and existing employees.

- Boost productivity and engagement: Benefits that support the health and well-being of your employees, such as mental health programmes and wellness stipends, can help to contribute to a more motivated and productive workforce.

- Provide financial security: Pension contributions, work stipends, and financial planning support help employees build long-term financial stability, reducing stress and increasing job satisfaction.

- Enhance work-life balance: Flexible work policies, paid parental leave, and time off help employees enjoy their work alongside their personal life, helping to improve retention and reduce attrition rates.

- Strengthen employer brand and culture: Employee benefits that reflect company’s values and culture help to create a strong employer brand – helping to show candidates what the company is going to be like.

Types of employee benefits

Designing an employee benefits package can be hard work – especially for global companies with employees working from different locations.

For People and Reward leaders, it means striking the right balance between market competitiveness, budget, company values, and legal compliance with local laws.

These factors will naturally change the overall benefits package that your organisation can offer.

Generally speaking, employee benefits fall into three main categories:

- Mandatory benefits

- Enhanced mandatory benefits

- Additional benefits (or perks)

"Take a holistic view of rewards, including your employee benefits package, and think about the behaviours you want to incentivise. Clear priorities and alignment are essential for success."

Chief People Officer at Ravio

Mandatory benefits

Mandatory, or statutory, benefits are the legally required or essential provisions that provide employees with financial security and stability.

These vary by country, meaning that companies operating in multiple regions must ensure compliance with local labor laws. Here’s a snapshot of mandatory benefits across the UK, France, Germany and the USA.

Enhanced mandatory benefits

Enhanced mandatory benefits go beyond legal requirements and are offered at an employer’s discretion to attract top talent and enhance the overall employee experience. Done right, these benefits can significantly impact job satisfaction, retention, and workplace culture.

Types of enhanced mandatory benefits include:

- Health and wellness: Some employers offer private health insurance even if it’s not a legal requirement while others may decide to offer better health insurance above the statutory level. Google is famous for its additional perks in this area, even adding onsite medical care as an employee benefit.

- Paid time off (PTO): Many companies exceed statutory holiday allowances by offering extra vacation days, paid volunteer leave, or unlimited PTO policies. Some also provide additional leave for special occasions like weddings or milestone birthdays.

- Family benefits: Enhanced parental leave, fertility treatments, adoption support, and childcare subsidies help employees balance work and family life. Some companies, like Salesforce, reimburse up to $10,000 for fertility treatments.

- Financial security: Beyond base salary, employers can also choose to offer financial planning services and retirement savings top-ups to support employees' financial futures.

- Learning and development: Many companies invest in training budgets, tuition reimbursement, mentorship programmes, and career coaching to foster continuous learning.

- Flexible work: Remote and hybrid work models, 4-day workweeks, and home office stipends have become much more common in recent years, with many well-known brands like Airbnb offering fully remote work.

Additional benefits (or perks)

Additional benefits, or perks, are other benefits that enhance the employee experience, often more flexible or culture-driven.

Some examples include:

- Free office lunches

- Gym membership

- Covering commuter costs

- Dog-friendly office

- On-site childcare

How do employee benefits vary across Europe?

Employee benefits vary across Europe, influenced by local laws and the type of industry, size and budget they have.

Some, like parental leave, are legally required, while others, like learning and development (L&D) stipends, are offered competitively to attract talent.

Here’s a few examples of how parental leave requirements vary across Europe:

- 🇸🇪 Sweden: One of the most generous schemes, with 480 days of paid leave, shared between parents.

- 🇩🇪 Germany: Mothers receive 14 weeks of fully paid maternity leave (six weeks before birth and eight weeks after). Parents can also take up to 14 months of shared parental leave, with pay based on a percentage of previous income.

- 🇫🇷 France: 16 weeks of fully paid maternity leave, plus additional unpaid parental leave.

- 🇬🇧 UK: Up to 39 weeks of paid maternity leave, with only the first 6 weeks at 90% of salary, then dropping to a lower statutory rate.

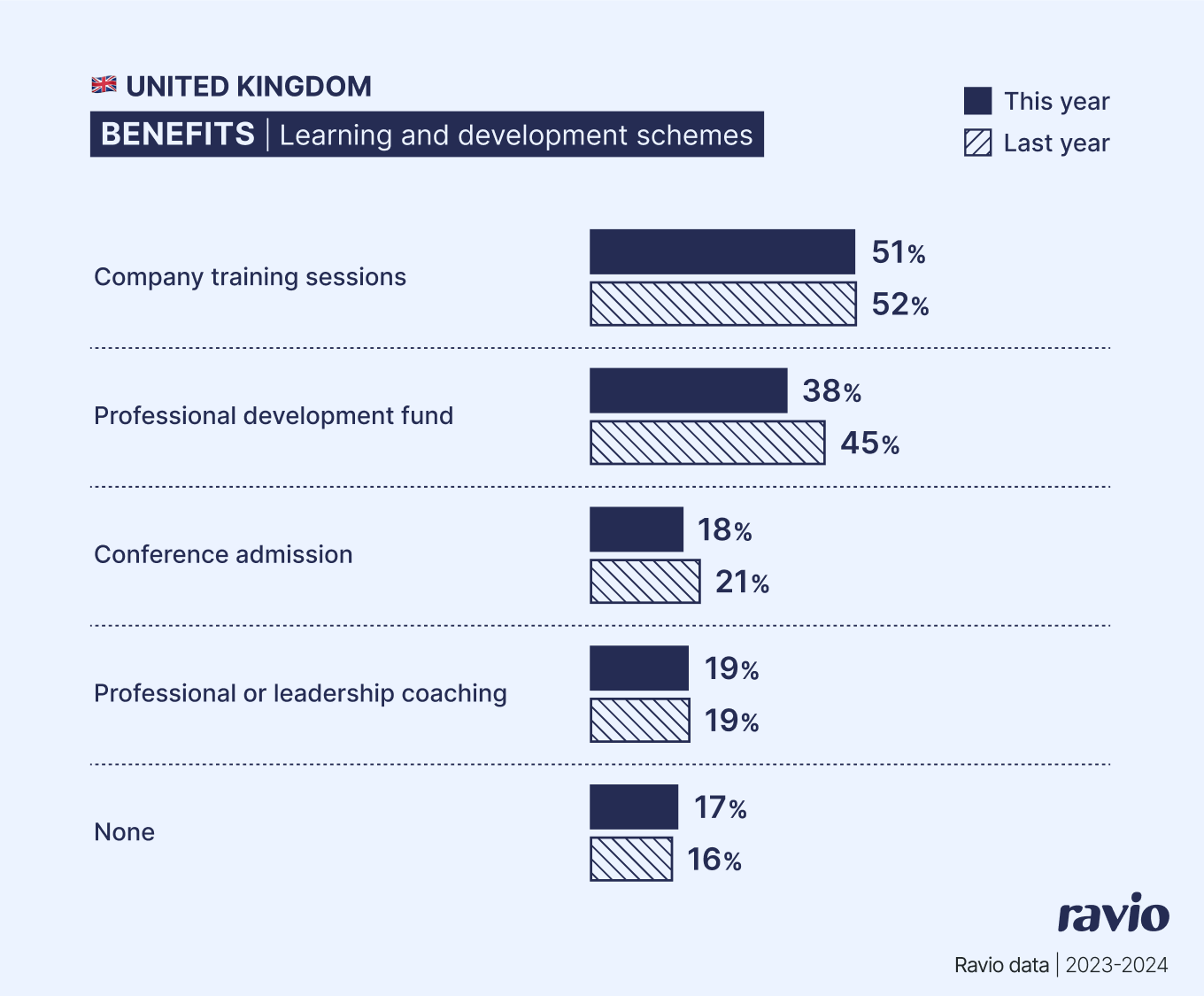

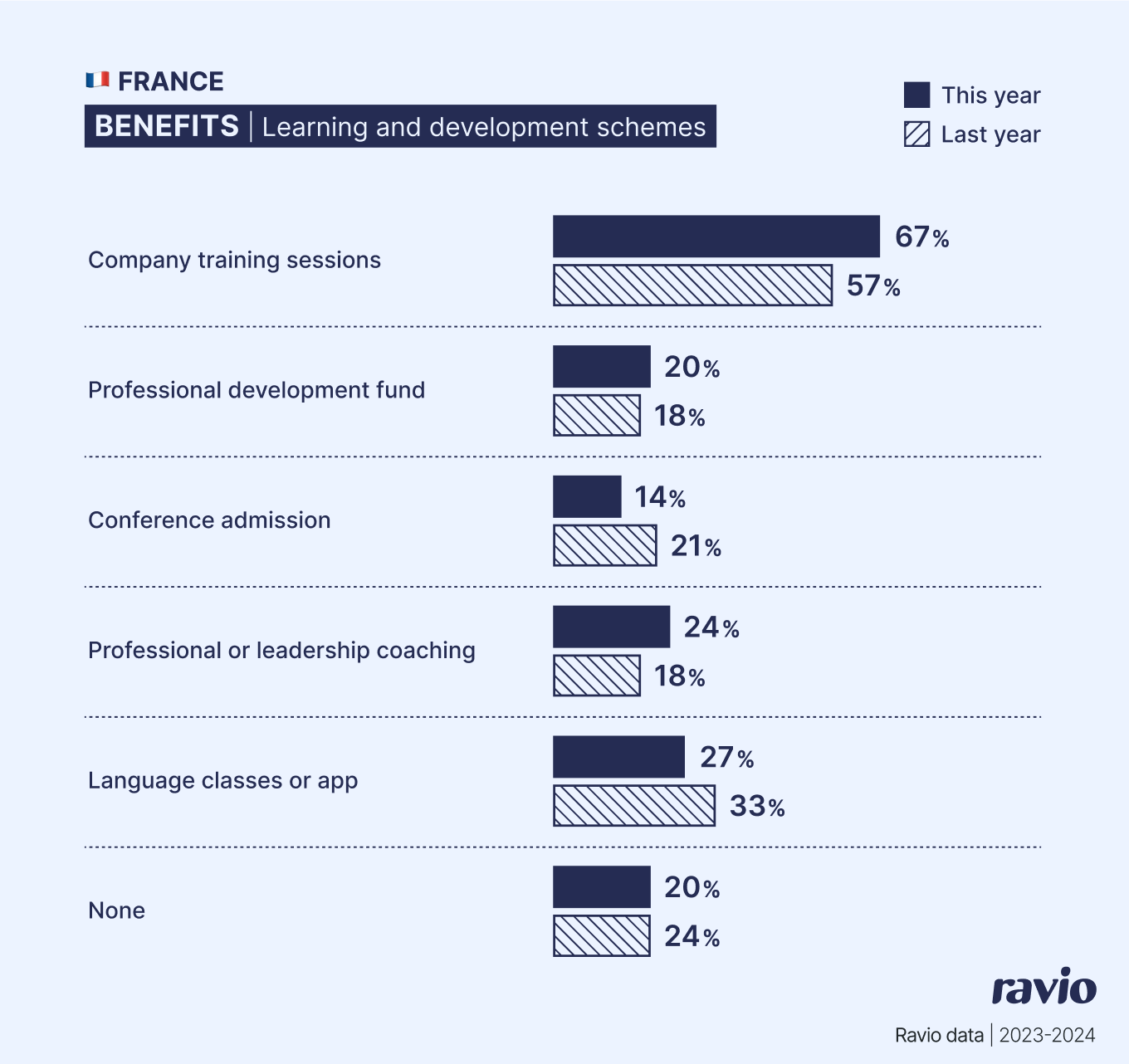

Unlike parental leave, learning and development benefits are not legally required – and typical approaches vary across different countries in Europe.

We can see from Ravio’s benchmarking data (2023-4) that in the UK the most common L&D offering is company training sessions. Notably, 17% of companies aren’t offering and L&D benefits, which is surprising given their value to employees.

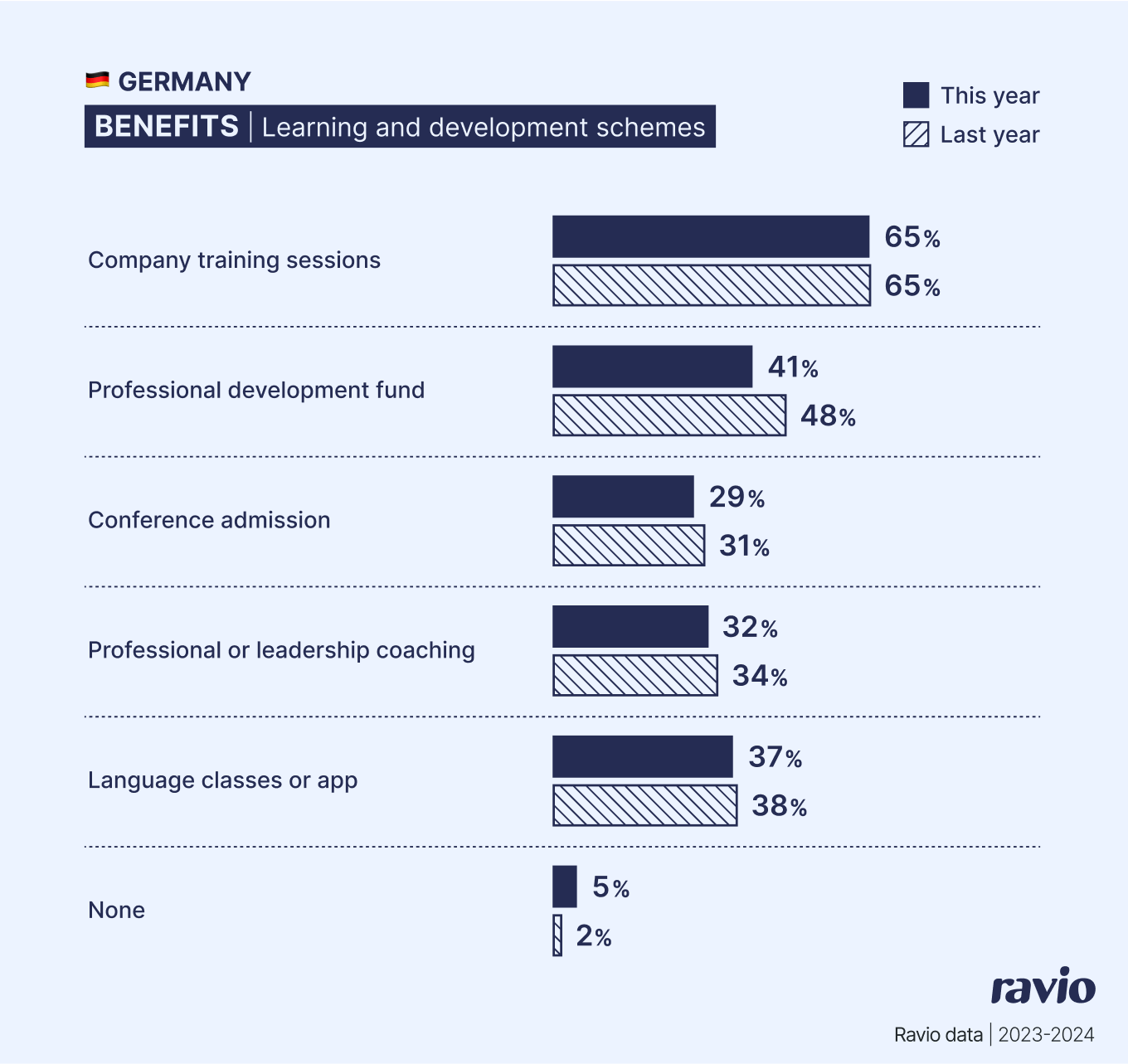

In Germany the majority of employers do offer some form of learning and development within their employee benefits package, with the most common being training sessions and a professional development budget for employees.

France leads the way when it comes to company training sessions, offering 67% of their employees company-wide training sessions.

How to build a competitive employee benefits package: a step-by-step guide by Vaso Parisinou, CPO at Ravio

Because every company approaches benefits differently, it can be tricky to know where to start.

There isn’t a map to follow, and designing a package for your company depends on a ton of different factors already outlined in this post.

To help, we spoke to Vaso Parisinou, CPO at Ravio to outline a step-by-step guide to building a competitive employee benefits package.

Step 1: Define the objectives

Before selecting benefits, it's crucial to clarify why your company is offering them.

A well-designed benefits package isn’t just about fun perks – it should be an intentional extension of your compensation philosophy, reinforcing your company's values, goals, and culture.

Start by asking:

- What role do benefits play in our total compensation strategy? Are they a way to supplement lower salaries, or a competitive differentiator?

- How do benefits align with our company values? For example, if flexibility is a core value, remote work stipends or additional paid leave might be prioritised.

- Are we looking to improve employee well-being, support work-life balance, or enhance financial security?

- Do we want to stand out in a competitive talent market by offering unique or industry-leading benefits?

To take one example, Wise’s mission is creating “money without borders”, and because of that they have shaped many of their employee benefits around flexible working and bringing global employees together.

"Your benefits strategy should be a direct reflection of your compensation philosophy. If your company prioritises transparency, that should show up in how benefits are structured and communicated. If you focus on attracting top talent, you may lean into market-leading benefits like generous parental leave or learning stipends."

Chief People Officer at Ravio

Step 2: Set a budget

Once you’ve defined your objectives, the next step is determining how much to invest in employee benefits. Without clear budgeting, companies risk overspending on benefits employees don’t value or underinvesting in areas that could improve retention and engagement.

Some companies budget for benefits based on a percentage of base salary, allocating 15-25% of base salary to an employee benefits budget. For instance, if employee salaries total £5 million per year, and you allocate 20% of base salary for benefits, your benefits budget would be £1 million. Other companies budget based on a set cost per employee.

Whatever approach you take, the key is to balance the cost of benefits with the value they provide for employees.

For more advice on budgeting for employee benefits, head to the section below ‘How to budget for employee benefits’, where Vaso shares her experience.

Step 4: Gather employee input

The best employee benefits programmes are built with direct employee feedback.

Conduct surveys, focus groups, or one-on-one interviews to understand what employees truly value. While free lunches might appeal to some, others may prioritise learning and development stipends or enhanced parental leave.

In terms of overall shifts in what employees want from their benefits package, a recent Ciphr study found that in the UK the top benefits are:

- Paid sick leave

- Flexible working

- Pension contribution matching

- Mental health and wellbeing support

- 4-day work week

A similar OnPay study for US employees found:

- Health insurance

- Paid time off

- Retirement benefits

- Dental insurance

- Vision insurance

"As the demographic of your employee population changes, so too will your benefits package. Make sure you build a benefits package that scales appropriately – you can always add to it but it’s a lot more painful to cut down on benefits previously offered!”

Chief People Officer at Ravio

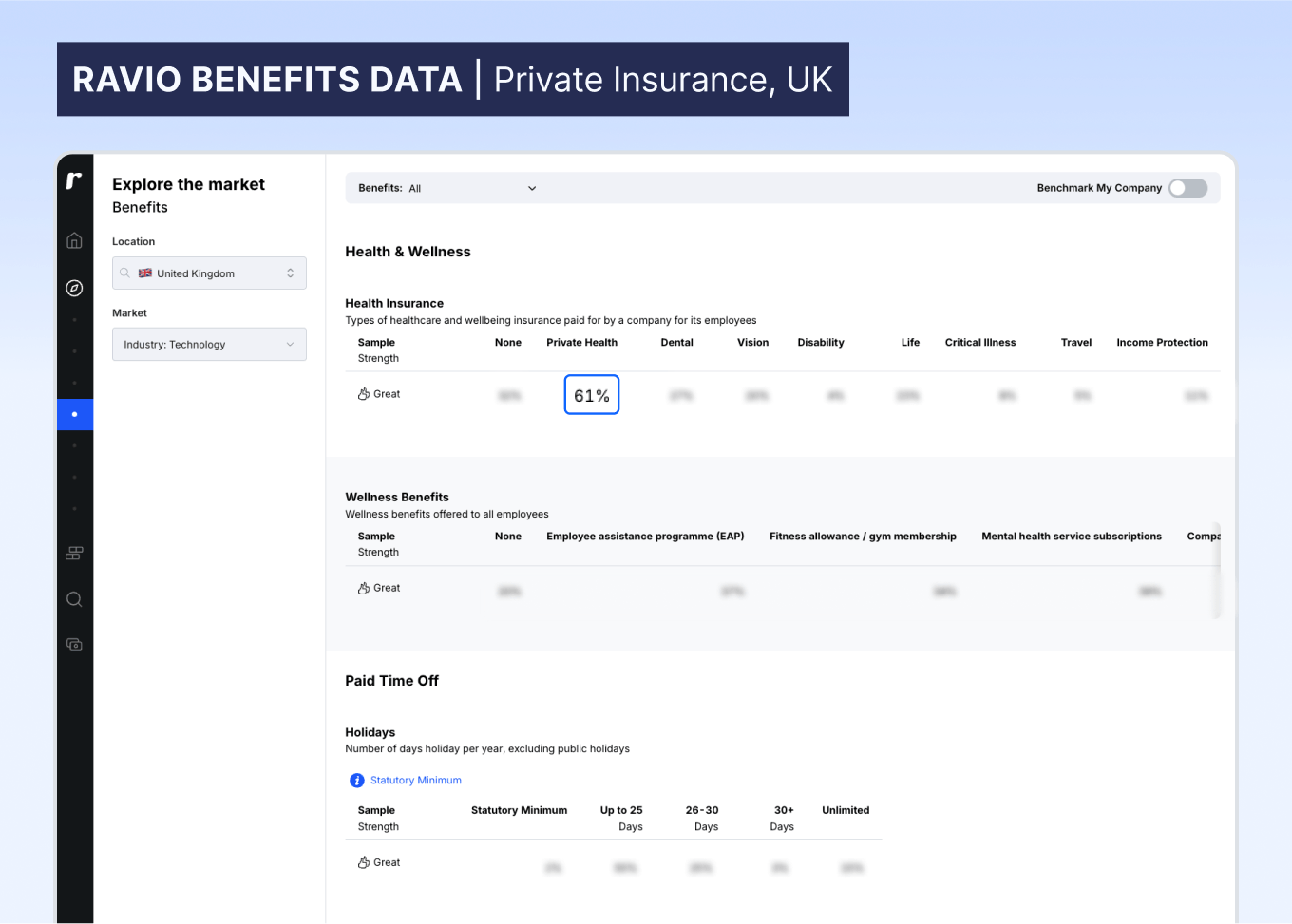

Step 4: Benchmark against market standards

Use employee benefits benchmarking data to compare your offerings against industry norms.

This helps identify gaps in your benefits package and ensures that you remain competitive with companies in a similar growth stage, size, industry, and geography.

For example, if the data highlights that 61% of companies in your sector offer private health insurance but you don’t, you may be at a disadvantage in attracting top talent – as is the case in the UK tech industry based on Ravio’s data.

Step 5: Strike the right balance between mandatory and enhanced mandatory benefits

How do you decide which benefits to offer beyond the mandatory ones?

Vaso Parisinou, Chief People Officer at Ravio suggests aligning benefits with company values. For example, Ravio’s value of making compensation work for everyone is reflected in their benefits package which includes excellent pension contributions and parental leave policy – both above the statutory amount.

"I've seen companies offer all kinds of benefits – some that employees truly value and others that go unused. The key to getting it right is to stay true to what your organisation stands for. Your company values should be the North Star that guides your benefits strategy, ensuring they are meaningful, relevant, and aligned with the culture you want to build."

Chief People Officer at Ravio

Step 6: Ensure flexibility and customisation

A one-size-fits-all approach to benefits is outdated – different employees will value different benefits offerings.

So, when designing a competitive employee benefits package, offering flexible or personalised benefits can be a huge game-changer. This might be as simple as choosing how much to put away for retirement savings, or it could be choosing to opt in on childcare related benefits for people that might need it at that point in their life.

Netflix is a great example of flexibility and customisation in their benefits package, where they purposefully reflect their value of “almost no rules”, giving employees the freedom to choose when it comes to employee benefits. This ensures that the benefits that are used are the ones that people value most.

That said, Vaso does point out that this introduces quite a bit of administrative burden on companies – something that is important to be aware of, especially for early stage companies that might now have the manpower to support it, or for larger companies that are increasing headcount.

"Flexible benefits are a huge advantage for employees, but they come with operational cost. The more personalised options you offer, the harder they are to manage. It’s even trickier when administering benefits across different countries. The key is balance: offer enough choice to make benefits meaningful without overcomplicating administration. Start simple, scale smart.”

Chief People Officer at Ravio

Step 7: Plan for communication and implementation

Even the best benefits package will fall flat if employees don’t know what’s available to them or how to use it. Simply mentioning benefits during onboarding isn’t enough – employees forget, overlook details, or may not see the immediate relevance.

To help combat this, companies need clear, ongoing communication when it comes to employee benefits. Ensure you:

- Make benefits easy to find: Have a centralised, self-serve hub (like a Notion page or HR portal) where employees can check what’s available at any time. This should include: what the benefit is, why it’s valuable, the financial impact (e.g. savings or contributions), how to access it.

- Keep benefits top of mind through regular reminders: Regular, bite-sized reminders help employees make use of their benefits, such as monthly emails or Slack reminders.

- Leverage managers as benefits champions: Managers can play a big role in benefits awareness by bringing them up in conversations with their direct reports.

- Personalised nudges: Sometimes, employees just need a little push or reminder to remember they have the benefits available to them.

Step 8: Review and iterate annually

Employee benefits aren’t static, they need to evolve with shifting workplace expectations, market trends, and employee needs. What was valuable five years ago is likely to be irrelevant today.

Keeping your benefits package competitive and meaningful means reviewing and iterating on it annually – with three key elements in the review process.

Firstly, market benchmarking.

Access to reliable employee benefits benchmarking data is vital to understand market trends and take that into account when improving your benefits provisions. For example, commuting benefits before the pandemic were highly valued, whereas now flexible working policies have taken priority.

Secondly, employee feedback.

It’s important to regularly ask employees for feedback to understand which benefits are being used, which aren’t, and where new needs are emerging.

But remember that if a benefit has low engagement, it doesn’t necessarily mean it should be scrapped, it could just need better communication.

A good example is pension schemes. Younger employees often don’t see the value in being able to increase how much of their salary goes into retirement savings now, but it’s very much in their best interest to do this – so financial education is needed, rather than removing additional pension contributions.

And finally, societal shifts.

For Vaso, industry and cultural context plays an important role when reviewing and improving benefits. Take parental leave, for instance.

“Parental leave expectations have changed drastically over the years,” says Vaso, “There was a time when statutory paternity leave – just two weeks in many countries – was the norm and no one would have thought to ask for more. Today that just wouldn’t fly. If you’re trying to attract younger employees who are thinking about starting a family, offering only the minimum could put you at a serious disadvantage."

How to budget for employee benefits

Without proper planning, companies risk overspending on benefits that employees don’t use or underspending in areas that could improve retention and engagement.

We asked Vaso Parisinou, Chief People Officer at Ravio, for her advice on how to budget for employee benefits effectively.

1. Assess current costs and usage

Before making any decisions about new benefits, analyse existing cost and usage. This means calculating the average cost of benefits per employee overall, as well as reviewing data on historical expenses submitted for optional benefits like wellness stipends or health insurance.

This will help you identify any benefits that are high-cost but low-use, making them candidates for being replaced, removed, or better communicated.

💡 Vaso’s tip:

"Your workforce will evolve, and so will their needs. A benefit that made sense at 50 employees might not work at 500. Keep reviewing your benefits to ensure they stay relevant."

2. Categorise and prioritise benefits

Not all benefits are created equal. Some are essential for compliance and competitiveness, while others are discretionary perks.

Structuring benefits into tiers ensures budget allocation reflects both aspects in terms of required spend for legal compliance, and additional spend for other benefits to enhance employee total compensation.

For instance, your tiers might look like this:

- Mandatory benefits (varies by country): Health insurance, pension contributions, statutory paid leave.

- Core benefits (high-impact and competitive): Mental health support, wellness stipends, tuition assistance.

- Perks (‘nice-to-have’ extras): Gym memberships, free meals, pet insurance.

💡 Vaso’s tip:

"It’s really hard to take benefits away once they’ve been introduced. Instead of rolling out an extensive package from day one, start with a strong core set of benefits and build from there. Future-proofing your benefits strategy means designing something that can scale, not something that will become a financial burden."

3. Decide how you will set the budget

Companies should establish a clear budget framework that balances financial sustainability with employee expectations.

One common approach is to budget for benefits based on a percentage of base salary, allocating 15-25% of base salary to an employee benefits budget. For instance, if employee salaries total £5 million per year, and you allocate 20% of base salary for benefits, your benefits budget would be £1 million. Other companies budget based on a set cost per employee.

Access to benefits benchmarking data from a provider like Ravio is important here to help you understand what a typical employee benefits package is for companies of your size and stage.

💡 Vaso’s tip:

"Before locking in a benefits budget, ask yourself: how do benefits fit into your broader compensation philosophy? Are you prioritising high base salaries, or are benefits a core part of your attraction and retention strategy? The answer will shape your approach."

4. Explore cost-effective solutions

There are several ways to optimise benefits spend without reducing quality, including:

- Self-funded health plans: Larger companies can consider self-insuring for healthcare to save costs.

- Voluntary benefits: Offer additional benefits partially funded by employees (e.g., enhanced dental coverage, private pension contributions).

- Negotiate group rates: Partnering with benefits providers for bulk discounts can significantly lower costs.

💡 Vaso’s tip:

"Your benefits budget is not just about what you spend – it’s about how smartly you spend it. Regularly review your providers, negotiate better rates, and explore flexible options to ensure maximum value for your employees."

5. Plan ahead for inflation and future growth

Failing to account for inflation and workforce expansion can result in budget shortfalls over time.

- Factor in healthcare cost inflation: Medical costs typically rise 5-7% annually, requiring proactive budget adjustments.

- Plan for workforce expansion: If headcount is expected to double in three years, benefits costs must scale proportionally.

- Build flexibility into benefits design: Opt for modular benefits structures that can expand without major cost spikes.

💡 Vaso’s tip:

"Benefits planning isn’t just about today – it’s about where your company will be in 2, 3, or even 5 years. Always think long-term. A benefits package should be scalable, adaptable, and sustainable.”

7 examples of benefits packages

Many companies today – especially in tech – offer core benefits like private healthcare, pension contributions, and paid time off. These have become standard across industries. However, the benefits that differentiate an employer’s benefits package can often be the ones that go beyond the basics to attract, retain, and support their workforce.

From unlimited paid leave at Netflix to fully funded tuition at Amazon, we’ve highlighted companies that offer unique and standout benefits, giving a snapshot of what makes each package distinct.

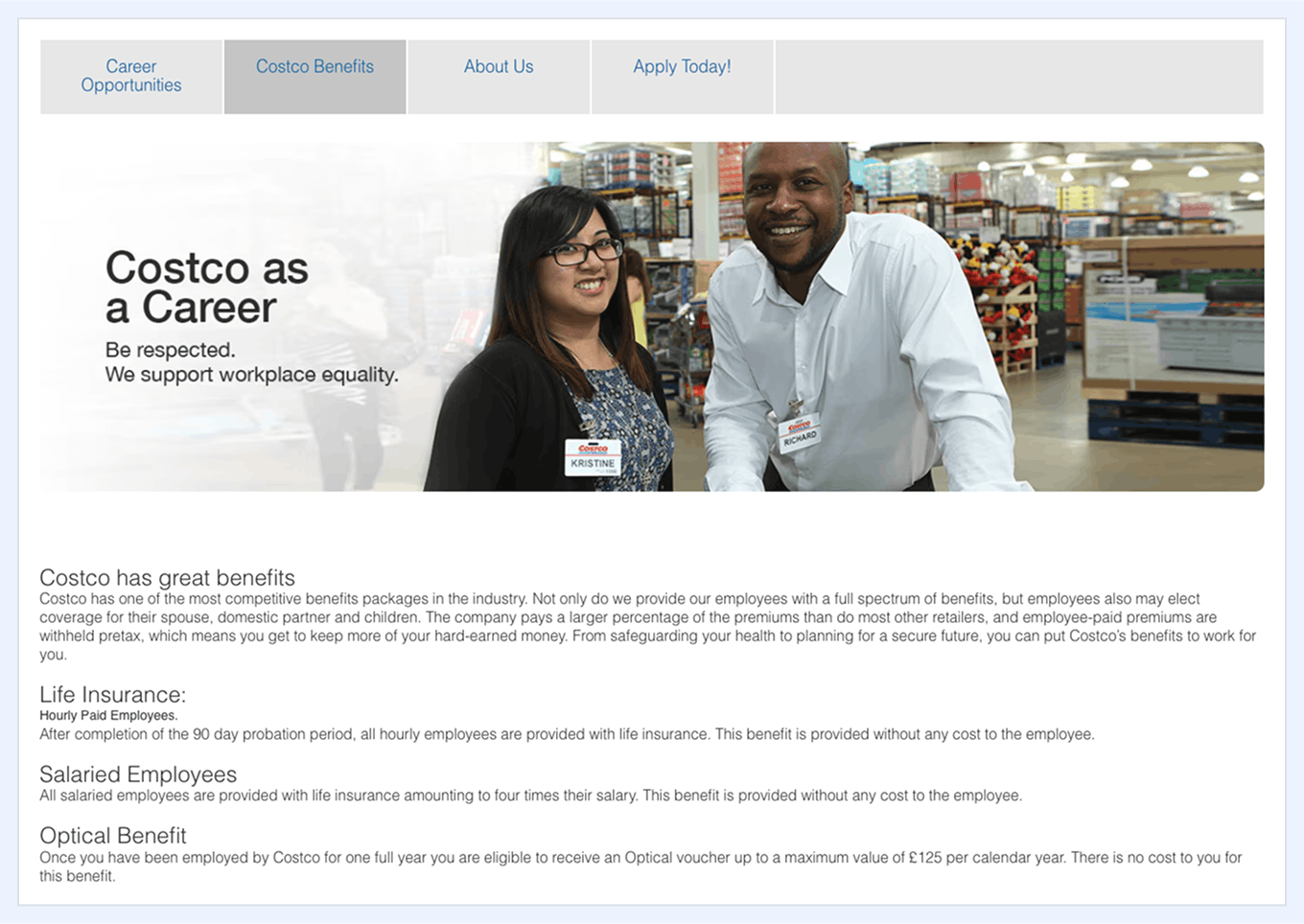

Example 1: Costco employee benefits

Costco offers a comprehensive list of employee benefits, offering private healthcare, pension contributions, and paid time off as well as additional, optional benefits and perks. Costco also states on their website to have an emphasis on affordability, reflecting its own value as a retailer, by paying a larger percentage of the premiums that most other retailers do for their employees.

What makes Costco employee benefits unique?

- Healthcare and wellbeing: Private healthcare with medical, dental, and vision for employees, spouses, and children. Coverage varies by country, but is offered to the US and UK full-time salaries employees and is reportedly continued into retirement if you have worked at Costco for 10+ years.

- Financial security: Costco offers pension contributions, with a particular focus in the US where the company will match up to 50% of your first $1,000 in 401(k) contributions up to a maximum of $500 per year.

- Holiday: Costco offers paid vacation time in addition to eight paid holidays per year with one floating paid holiday to allow employees to observe a day that’s meaningful for them. However, the amount of PTO reportedly differs depending on how long each employee has been at the company.

- Workplace perks: Free Costco membership and employee discounts.

- Parental and family support: Paid parental leave and an Employee Assistance Programme (EAP) with free counselling.

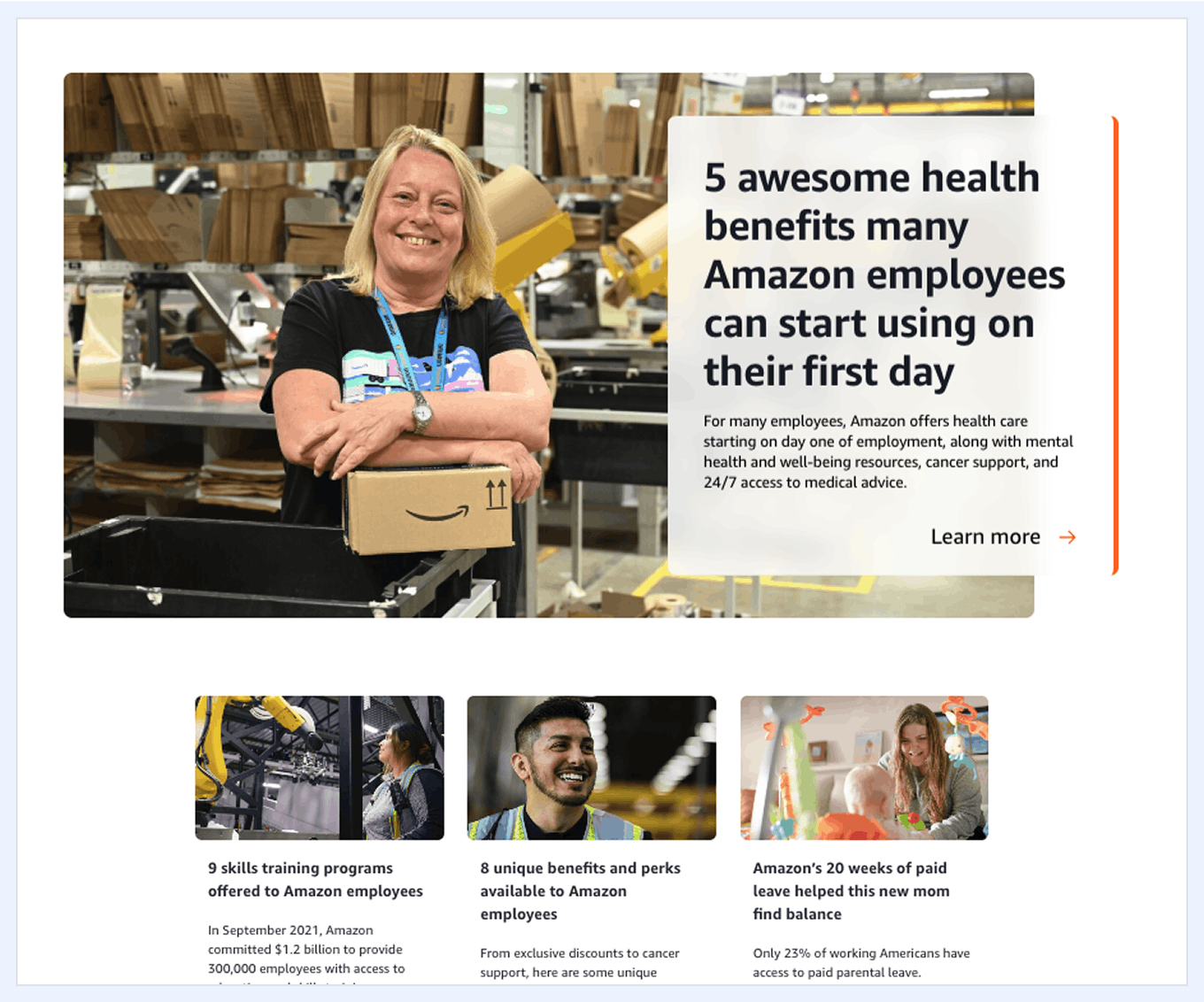

Example 2: Amazon employee benefits

Amazon provides private healthcare, pension contributions, parental leave, with benefits that also help career progression and education. Here’s a snapshot of Amazon’s employee benefits.

What makes Amazon employee benefits unique?

- Healthcare and wellbeing: Amazon offers all full-time employees private medical insurance regardless of their level, tenure or position. Amazon also offers cancer support through their CARES programme along with mental health support.

- Parental and family support: Amazon offers six weeks paid parental leave in the US (given there is no mandatory requirement, this is typically what a lot of tech companies offer). In the UK, Amazon pays 100% of the employee’s salary for 4 weeks pre-partum and between 10-16 weeks post-partum, depending on tenure. Overall this is up to 20 weeks parental leave in addition to the statutory amount. Amazon also offers a Leave Share programme, which provides six weeks of paid parental leave to a spouse or partner who isn’t eligible for parental leave from their employer.

- Financial security: Amazon offers up to 2% matching in their 401k plan for US employees and up to 5% matching for UK employees – 2% higher than the statutory minimum in the UK – as well as emergency saving funds, employee discounts and more.

- Learning and development: Amazon pays for college tuition for all US front-line employees through its Career Choice programme, including fees, classes and books. Amazon also offers education programs to provide employees with the opportunity to learn skills in certain sectors, including data center maintenance and technology, IT, and user experience and research design.

- Workplace perks: Discounted childcare, eldercare assistance, and specialist family support for neurodiverse children.

Example 3: Google employee benefits

Google offers private healthcare, pensions, and paid leave, but what sets it apart is its top-tier perks and flexible work culture.

What makes Google employee benefits unique?

- Healthcare and wellbeing: Google offers private healthcare, including medical, dental, and vision insurance for all employees at Google and their families – regardless of location. Google also offers healthcare benefits such as mental health programmes, onsite wellness centers,and fertility and growing family support.

- Parental and family support: Google has a global minimum of 18 weeks of paid leave for all new parents – 24 weeks for birthing parents and 18 weeks for non-birthing parents. This is significantly higher than the statutory minimum in any country, and also higher than other competitors in the industry. Currently, only Netflix offers more parental leave than Google – with an unlimited amount in the first year (see below example).

- Time off and flexibility: Hybrid working and four "work from anywhere" weeks per year.

- Workplace perks: Free meals, wellness centres, and fitness facilities.

Example 4: Netflix employee benefits

Netflix is famous for its “almost no rules” work culture, and its employee benefits reflect this. From unlimited parental leave and PTO to an unstructured workday, Netflix aims to reinvent employee benefits. Here’s a snapshot of a few benefits they offer.

What makes Netflix employee benefits unique?

- Healthcare: Netflix offers medical benefits to all employees across the globe, although the coverage does differ depending on where people are located. Some may have healthcare covering through Netflix, or a third party, or others may have a monthly stipend to purchase healthcare benefits on their own. Netflix also has an onsite clinic in many of their locations.

- Parental leave: Netflix offers an (almost) unlimited amount of time for new parents so that parents can “take care of your child and yourself.” They encourage employees to speak to their manager about how much time they need, with Netflix offering up to a year of pay after the baby is born. Despite this approach coming under fire based the argument that manager discretion can invite a lot of subjectivity and judgment, this is far higher than statutory offerings and Netflix does lead the way with this amount of parental leave.

- Time off: Netflix also offers unlimited number of vacation days for full-time, salaried employees, depending on their location and role. Netflix believes in flexibility, so people can take the time they need when they need to.

- Workplace perks:Free lunch (5 days a week), onsite fitness classes, early access to Netflix productions and events.

Example 5: Apple employee benefits

Apple provides private healthcare, pensions, and time off amongst other benefits. Here’s a few that stand out.

What makes Apple employee benefits unique?

- Healthcare and wellbeing: Apple offers flexible medical plans that include both physical and mental health. Employees globally, including the UK, can opt in for free counselling sessions, and those based in major hub locations throughout the US can access onsite wellness centres. Apple also offers spousal support for critical illness as well as fertility

- Parental and family support: Apple offers paid parental leave for all employees, as well as a gradual return-to-work programme. In the UK, employees who are pregnant are entitled to Ordinary Maternity Leave and Additional Maternity Leave – which can span up to 26 weeks each regardless of the employee's length of service.

- Career growth and learning: Apple has their branded “Apple University” included in their employee benefits, meaning employees can develop both professionally and personally through classes and seminars to help sharpen general business and software skills. Apple will also reimburse employees for certain educational expenses, too.

Example 6: Microsoft employee benefits

Microsoft provides private healthcare, pensions, and parental leave, but places extra emphasis on flexible time off and mental health support. Here’s a snapshot on benefits offered at Microsoft:

What makes Microsoft employee benefits unique?

- Healthcare: Microsoft offer private healthcare for all employees, as well as a health savings account that Microsoft contributes $1000pa into. Alongside this, Microsoft also have onsite clinics and offer 10 days sick pay.

- Parental and family support: Microsoft offers 20 weeks of maternity leave and 12 weeks of paternity leave for all employees globally – above statutory minimum for all countries, especially the US where there is no mandatory requirement.

- Time off: Microsoft offers unlimited PTO for all employees.

- Workplace perks: Microsoft offers a long list of additional perks, including free breakfast, up to $1500 annual wellness stipend, and a gym onsite for use.

Example 7: Salesforce employee benefits

Salesforce’s employee benefits are highly competitive. Here’s a snapshot of what’s on offer:

What makes Salesforce’s employee benefits unique?

- Healthcare and wellbeing: Salesforce provides extensive health benefits, including medical, dental, and vision insurance. In the US, employees have access to Health Savings Accounts (HSAs) with employer contributions of $750. In the UK and EMEA regions, health coverage aligns with local standards and often exceeding statutory requirements.

- Financial security: In the US, Salesforce offers a 401(k) plan with a 100% match on the first 6% of base salary, up to $5,000. For UK and EMEA, employees can opt in for 2% and Salesforce will contribute 8% – far higher than the 3% statutory minimum in the UK.

- Parental leave: Salesforce offers all employees parental paid leave – 26 weeks for the birthing parent, and 12 weeks for non-birthing parent. This is far higher than statutory minimums across different locations.

- Paid Time Off: Salesforce offers unlimited PTO to all employees, which is in line with what other big tech brands offer.

- Career development: Salesforce supports continuous learning by reimbursing fees, tuition, and books up to $5,250 annually for job-related education.